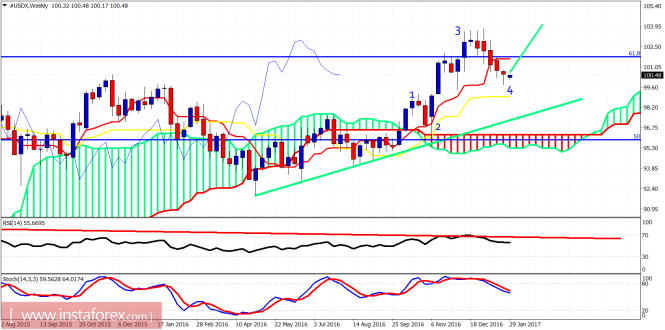

The Dollar index has made an important low last week at 99.79. This low could be a wave 4 low and we could be now at the early stages of wave 5 up targeting 105-106. In the short-term term price has given bullish reversal signals.

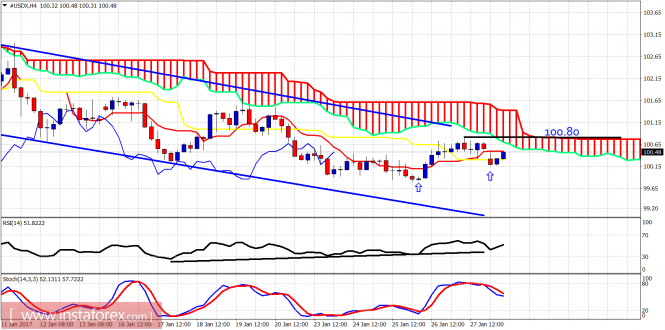

Blue lines – bearish channel

Black line – resistance at 100.80

The Dollar index is still below the Ichimoku cloud and inside the bearish channel but since last week we have bullish reversal signs and bullish divergence signs in the RSI. Short-term resistance is at 100.80. Support is at 100.15. A break above resistance will push the index towards 101.15 at least.

On a weekly basis price could already have completed a wave 4 correction at last week’s low which is also depicted by a bullish hammer candlestick pattern. Price has important long-term resistance levels at 101.80 and at 103 next. Breaking above these levels will strengthen the bullish scenario looking for 105-106. Worst case scenario is a move towards 102, a lower high and the creation of a right hand shoulder for a H&S pattern with the neckline at 99.80.The material has been provided by InstaForex Company – www.instaforex.com

The post Wave analysis of USDX for January 30, 2017 appeared first on forex-analytics.press.