Traders remain calm after strong labor market figures

In perhaps another sign that investors have gathered their composure after a tumultuous few weeks, market reaction to today’s stellar US jobs report has been relatively mild.

When you consider that the apparent catalyst for the market sell-off was Jay Powell’s comments on interest rates rising a lot further, today’s report always had the potential get an explosive response. Early signs suggest that particular bullet has been dodged leaving only the small issues of the mid-term elections and Fed interest rate decision next week to worry about, what could go wrong?

The reaction to today’s report has actually been very reassuring under the circumstances and coming on the back of a decent recovery this week. The highest wage growth since 2009 and 250,000 new jobs which is well ahead of expectations, could have easily got a stronger response but instead it’s been quite tame, which I don’t think many will complain about.

Obviously the caveat to this is that the earnings number was in line with expectations whereas the increase in jobs was partially offset by last month’s revision and likely partly due to the extreme weather conditions in September. Still, we got through the report relatively unscathed, hopefully clearing the way for a relaxed end to the week which will provide an additional layer of comfort heading into what could be a big week for the US.

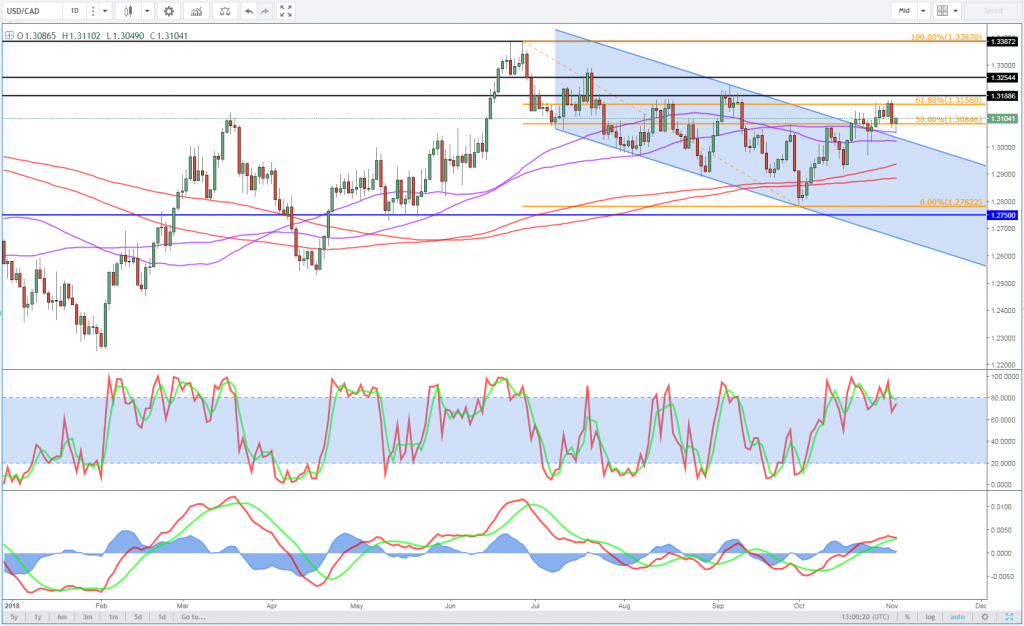

OANDA fxTrade Advanced Charting Platform