By Chris at www.CapitalistExploits.at

Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing.

Welcome to this week’s edition of “World Out Of Whack” where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all its glorious insanity.

While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the “World Out Of Whack” as your double thick armour plated side impact protection system in a financial world littered with drunk drivers.

Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live.

Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar – because, after all, we are capitalists.

In this week’s edition of the WOW we’re covering financial repression

We all remember the GFC which scared the bejeezus out of markets, sending central banks into hyperdrive as they scrambled to contain what was the equivalent of a financial nuclear disaster. The fallout threatened to cascade across the world, bringing down financial counterparts and in the process putting Clive’s auto spares in Tulsa, Janet’s hair salon in Woolloomooloo, and Juan’s barbershop in Cordoba all out of business. It had to be stopped!

The medicine came in many formats. TARP, QE, and all its siblings to name a few but by far the most powerful tool used has been the cost of capital: the federal funds rate in the US and its equivalent in the UK, Europe, and Japan.

The idea, like so many ideas dreamt up by the intellectuals of the privileged class who are rarely forced to deal with the ramifications of their theories, is simple enough: Nudge a key short-term interest rate up to discourage borrowing and halting inflation, or nudge it down loosening credit and spurring growth and employment. Easy!

Remember “the Great Moderation”?

This was when the intellectuals declared victory in managing the business cycle. Via deft use of their enormous brains and one steady hand on the tiller of interest rate policy and the other clutching a well deserved tumbler of Chivas they achieved a panacea of equilibrium. Genius!

As it turned out the decade of “the Great Moderation” was really more like the decade of free lunches and when the market figured out that nobody had been stocking the pantry in 2007 and 2008 all hell broke loose. The intellectuals were forced to put down the Chivas and stategemize new, bigger, sparklier ways to “fix” the problem.

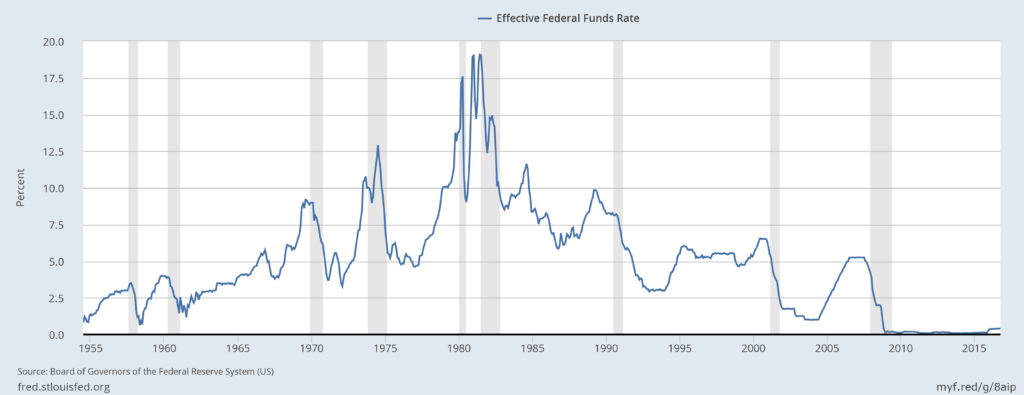

The results are shown in this chart:

The recession and credit crunch of 2008 dealt a staggering blow to demand, and in response central banks slashed benchmark interest rates close to zero, mistaking a lack of demand for insufficient credit. A mistake only a well groomed, manicured, and “distinguished” intellectual from the establishment class could make. Out of touch doesn’t begin to explain it.

The results have been unsurprising. Those who’ve bought financial assets have ended up with gold bathroom fittings and those who’ve not (middle and lower income) increasingly edge their way closer to those families you see on African charity ads and where kids have flies in their eyes.

And people wonder why “strong men” are being voted into power. History repeats.

When I wrote about this 4 months ago in I said:

“Since the 80’s the wealth gap has been growing consistently in most OECD countries and since the global financial crisis this inequality gap has exploded higher. Taking massive amounts of taxpayer money and doling it out to a tiny minority will do that.”

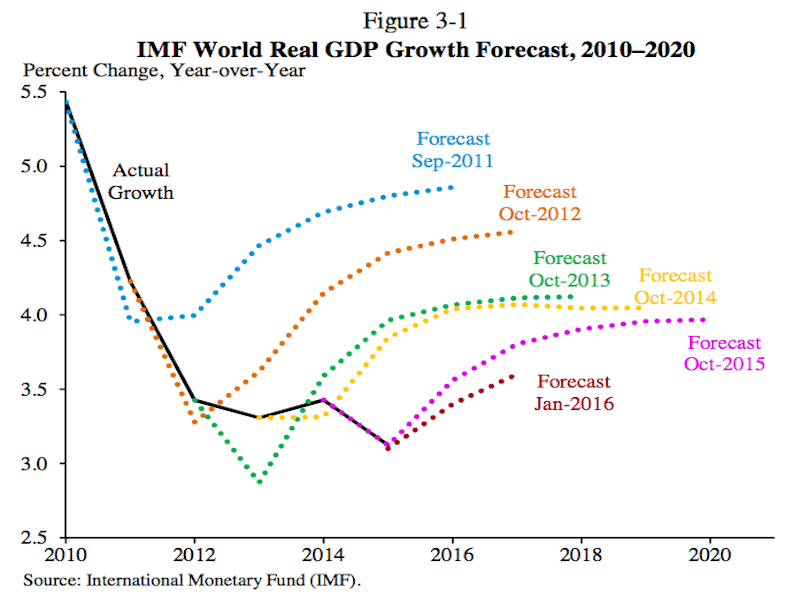

And while the inequality has risen, global growth has been stagnant or falling.

If inequality grows while at the same time global growth is rising everyone is still getting wealthier and consequently Joe Sixpack isn’t too concerned when Bartholomew Roberts Jr. the 3rd drives home in his new Bentley.

On the other hand, when the pie is shrinking and Joe Sixpack has to make the call between cutting the power and sending his daughter to school with shoes on things change.

This is how the political environment interacts with the financial economy. The two are intricately tied and can’t be viewed in isolation. They are reflexive to one another.

Now, 8 years later, the signs are there that two things are changing in the hallowed halls of the privileged:

- Monetary policy is at a dead end: “Janet, I tell you it just isn’t working. And I just got of the phone with Super Mario and you’ll never believe this but rumours are circling that some are calling him Mario and dropping the ‘Super’.”

- Politically the world is changing… and fast. For more on this topic go read “The Shifting Zeitgeist” and “What the Incoming “Strong Men” mean for the Global Economy”.

Next Step: Government Intervention (Financial Repression)

What am I talking about?

Financial repression is when government directly throw regulatory grit into the gears of financial dealings. Think of any policy that can capture capital and divert it to fund government debt and you’re on the right path.

Thus far we’ve seen slivers of this but it’s paled into insignificance in comparison to central bank monetary policy initiatives.

As we prepare for 2017 and what it may bring us I believe the combination of nationalism, protectionism, and “stupidism” will make for an irresistible cocktail of financial repression.

Remember folks, as I’ve been saying in these pages the rise of “strong men” comes with both a mandate and indeed a legitimacy to enact financial repression.

A Recent Example

I don’t know India particularly well, other than the fact that every time I’ve visited I’m guaranteed to pee from my bottom.

What I do know is that Prime Minister Narendra Modi is a perfect example of a “strong man”, and earlier this month he showed the world just how strong he is by banning the majority (86%) of cash in the economy.

Villagers queue outside a bank as they wait to deposit and exchange 500 and 1000 rupee notes in the northern state of Punjab (Photo by Getty Images)

Over in the US recent legal changes in the money markets has prompted capital to shift from “prime” funds, which buy short-term corporate debt, to US Treasury-issued debt. Governments can and will steer capital towards where they need it.

Historic Precedent

Few will remember it but in the 50’s and 60’s Brits weren’t allowed to take more than £50 out of the country and Americans weren’t allowed to own gold.

So what should we be on the lookout for moving into 2017?

In a 2011 paper co-authored with Maria Belen Sbrancia, Carmen Reinhart lists the following:

- Explicit caps or ceilings on interest rates, including caps on rates charged by the finance sector to governments,

- Indirect caps or ceilings on interest rates,

- Capital account restrictions,

- Exchange controls,

- High reserve requirements,

- Requirements to hold government debt,

- “Prudential” regulatory measures requiring that institutions hold government debts in their portfolios,

- Transaction taxes on equities,

- Prohibitions on gold transactions,

- Direct ownership of banks and other financial institutions,

- Extensive management of banks and other financial institutions,

- Restrictions of entry to the financial industry, and

- Directing credit to certain industries.

Since the topic is such a broad one I’m going to do something a little different this week.

For our World out of Whack poll I’m going to simply as the following question:

Cast your vote here and also see what others think

Cast your vote here and also see what others think

And then I’m going to ask you to let me know what benefits and what doesn’t benefit in such an environment. Go to the comments section and let it rip.

– Chris

“Financial repression in its many guises (with its dual aims of keeping interest rates low and creating or maintaining captive domestic audiences) will probably find renewed favor and will likely be with us for a long time.” — Carmen M. Reinhart

————————————–

Liked this article? Don’t miss our future missives and podcasts, and

get access to free subscriber-only content here.

————————————–

The post What Comes After Central Bank Intervention? appeared first on crude-oil.top.