The following article by David Haggith was first published on The Great Recessiong Blog:

In the fall of 2015, I said the Federal Reserve would raise interest rates once in December and then would not be able to fly any higher after that. The stock market would crash shortly after the Fed’s pulled up on the interest stick (which it did in what became the worst January in stock market history), and Fed’s hopes of recovery would fade away.

I also said that, in spite of a continually degrading economic situation around the world, the Fed would badly want to lift its interest target again in order to prove its recovery had recovered from the first lift. The fact that it would not be able to without stalling the economy completely wouldn’t mean it wouldn’t try. If it did try, however, it would find out in hindsight that any additional pull back on the stick would crash the economy into the dust of the earth.

Here we are half a year later. The collapse did not continue down as quickly as I thought it would. The stock market and oil market stabilized and recovered after January, but the US and global economy remain on a downward flight path, evidenced by falling GDP stats and rapidly declining job numbers.

The Fed certainly appears to be trapped. Fed officials have pounded the pavement to talk about their intention to raise interest rates, but every month faces additional reasons that the Fed is unable to do so.

You can put a toe tag on the Fed’s fake recovery now

The Fed’s plane called Recovery is disintegrating slowly, rather than in one huge blow-up. Six months out from lift off, it is clear that the forces against another rate increase are growing worse month by month.

The Fed’s chances of pulling up any higher are getting rapidly smaller. Globally, there is talk of Brexit and Grexit, and China is looking like a mountainside that could slide any day now. Japan’s one-hundredth attempt at economic recovery through quantitative easing has failed completely. Much of the world had descended into Alice’s Wonderland of negative interest rates for the first time in world history, as a last-ditch attempt to recover from the Great Recession (and to recover from their central banks’ failed recovery attempts). Two major European banks are failing, and Venezuela and Brazil have collapsed into economic chaos. (And those are just a few current headlines.)

Yet, the worst news for the Fed is right at home. The Fed’s plane never made it more than a few feet above the runway, when this week the illusory jobs recovery flew like a goose into the Fed’s left engine just as Captain Yellen was hoping to pull back on the stick for one more attempt to gain some interest altitude.

Yellen’s announcers had let the crowd know they should watch this next trick, so the crowd was attentively watching for the promised rate rise. Then down the nose dropped in what looked like a clumsily aborted take off, nearly skidding the plane’s nose back onto the runway. Whew! Many people must be asking, “Can she even fly that thing?”

Month after month, the Federal Reserve proves it is incapable of living off, though it keeps saying it will do so. It hinted at four rate increases in 2016, and so far has made exactly none.

Morgan Stanley compares the Recovery’s present flight attitude to the Great Depression:

“We think that the current macroeconomic environment has a number of significant similarities with the 1930s…. The critical similarity between the 1930s and the 2008 cycle is that the financial shock and the relatively high levels of indebtedness changed the risk attitudes of the private sector and triggered them to repair their balance sheets….”

“In 1936-37, the premature and sharp pace of tightening of policies led to a double-dip in the U.S. economy, resulting in a relapse into recession and deflation in 1938,” the analysts wrote. “Similarly, in the current cycle, as growth recovered, policy-makers proceeded to tighten fiscal policy, which has contributed to a slowdown in growth in recent quarters.” (NewsMax)

In talking about 2016, I said the crash that would come would be a second dip into the Great Recession. The Fed has shown that it fears even a mosquito-sized raise in interest altitude after half a year of skimming the runway could precipitate disaster.

No recovery is real if it can only exist under artificial life support, and this recovery has proved that it cannot exist outside of that artificial environment. At The Great Recession Blog, I have maintained for years that it the Fed’s recovery would die the second all life support ended, and the following job figures will show you that it is, in fact, dying.

Lipstick ain’t gonna make this pig perdy. Says Michael Feroli, chief U.S. economist at JPMorgan Chase & Co., concerning the latest jobs report:

It’s definitely the most concerning signal we’ve got recently.

Five indicators on the job market dashboard are red; there’s a bird in every engine

#1 Jobs report worse than expected and much worse than reported

The worst economic indicator of the past week was an abysmal Jobs report — the measure of new jobs announced. It was by far the worst jobs report in almost six years, showing a paltry gain of only 38,000 new jobs added to the economy while the number of working-age adults rose by 205,000.

Moreover, the number of new jobs that had been reported positively in the two previous months also proved to be deceptive and were revised down significantly. (That, of course, was tucked away in the fine print.)

To put a positive spin on hideous numbers, the Bureau of Labor Statistics (BLS, which should simply be BS) reported 484,000 formerly unemployed people are no longer unemployed. That’s fantastic! Well, except they omitted the banal explanation that this was simply because most of those people had been unemployed so long that their unemployment benefits expired. (Sighs. Just when you might have thought you felt some lift.)

Moreover, an all-time record of ninety-four-and-a-half million Americans are not part of the labor force. 180,000 more joined that number in May.

As Jim Quinn said on The Burning Platform,

We only need the other 7.4 million “officially” unemployed Americans to leave the work force and we’ll have 0% unemployment. At the current pace we should be there by election time…. Not one single full-time job has been added in 2016. There were 6,000 less full-time jobs in May than in January, while there are 572,000 more low paying, no benefits, part-time Obama service jobs. Sounds like a recovery to me.

It gets even better. The birth death excel spreadsheet “adjustment” added 224,000 phantom jobs into the May calculation. The lies – they burn…. IT’S ADJUSTMENT IS DEAD WRONG. In reality, jobs should be subtracted from the total. It added 231,000 phantom jobs in April too. The jobs numbers are much worse than the bad numbers being reported.

In other words, we would have actually had a report that said we had a net loss of jobs in May if not for some major “adjustments.” I commented last January on how the BLS reported a gain of 292,000 jobs for December, while only 11,000 of those were real jobs. The rest were upward “adjustments” due to the unseasonably warm winter. Then I noted that the previous year, the BLS had adjusted jobs upward by about the same amount due to the unseasonably cold winter.

What is stunning is not the fact that BLS reports are complete fabrications, but that no one commented on how the upward revisions from actual to “adjusted” jobs was about the same amount each year for completely opposite reasons. What’s stunning is how many people in the financial world and the financial media continue to put stock in these statistics, which are meaningless because of how arbitrary and inconsistent the adjustments are. Yet, those manipulated job numbers are routinely reported as if they are simple facts.

Apparently, even the Bureau of Lying Statistics was not able to find enough reasons to pump the numbers up enough this month to make May look good because they said there were no special factors related to the sharp fall in the jobs market. You know things must be bad when the BLS runs out of BS.

As Jim Quinn continued,

When you see lies, misinformation and deceitfulness at this level, you have to ask yourself whether this entire debt supported house of cards is about to fall. The smell of desperation is in the air. The MSM stories about a booming economy are rolled out on a daily basis. Meanwhile, the average family is being crushed by Obamacare, rising rents, rising food costs, and no interest on any savings they might have left.

Those dismal readings came in as the Fed reported that inflation is keeping its head down (because rising inflation would force the Fed to pull back hard on the interest stick and stall the Recovery. The Fed, however, formulates its inflation readings by factoring out most of the things households pay more for, such as health-care costs, and by having people guess at the rental value of the homes they are buying as a way of determining housing costs, even though most people have no educated basis for knowing the rental value of the home they are buying.

Economists — lately the worst people for seeing a recession when it is coming (or even after it is already here) –expected jobs to rise by 164,000, so they were off by more than 400%, even with all the help from BLS adjustments. Not surprising. If you want to believe those who couldn’t even see the Great Recession coming, do so at your own peril.

Here are the basics: we need about 200,000 new jobs a month just to keep up with population growth due to birth and immigration. The monthly average over the last three months has been barely half that much at 116,000 jobs added to the economy per month. Last year’s pace was almost double that at 229,000 jobs a month, so you can see how much the jobs economy has fallen off this year. The very gauge Janet Yellen likely watches most on the “dashboard” she talks about has dropped by half since the Fed declared its first minuscule uptick in interest rates. That’s a severe drop in performance.

Keeping up with population growth is, however, a little different than keeping up with labor-force growth because it takes awhile for babies to enter the workforce. The Wall Street Journal recently calculated we need 145,000 jobs a month just to keep up with growth in the labor force as babies grow to working age, migrants enter, and retirees exit, leaving their jobs behind. The monthly average in new jobs this year is clearly well below that, too.

#2 Unemployment benefit claims on the rise and also worse than expected

New jobless claims (unemployment-benefit claims) for May rose by 13,000 to a seasonally adjusted 277,000 new claims. Economists had expected claims to rise some, but not that much.

The number of people continuing on unemployment also rose by 45,000 to a total of 2.16 million, and the four-week moving average, which is the preferred measure, shifted from continued gradual improvement to a slight worsening, moving 1,000 people higher. So, for the first time in a long time the needle crossed from slowing but continued improvement past zero and into declining territory.

Belief that the Fed would raise rates in June or July was prevalent until the May jobs report punched a whole through one of the Recovery’s wings, changing everyone’s outlook, including the Fed’s.

Writes Joel Narroff on NewsMax,

Slowing job growth seems to have spooked the Fed and the members are becoming less certain about multiple rate hikes this year.

Instead of just one FOMC member expecting only one interest-rate hike this year, there are now six. So, the plane’s attitude has shifted considerably in just one week because of this bolide through its wing.

The “quits rate” also shifted from slowly rising to slowly falling. Seen as an indicator of how confident people are about the jobs market, the “quits rate” tracks how many people quit their jobs, perhaps because they got a better job offer or because they have decided to retire, or whatever. It has been moving up for years, but slumped this week into a marginal decline.

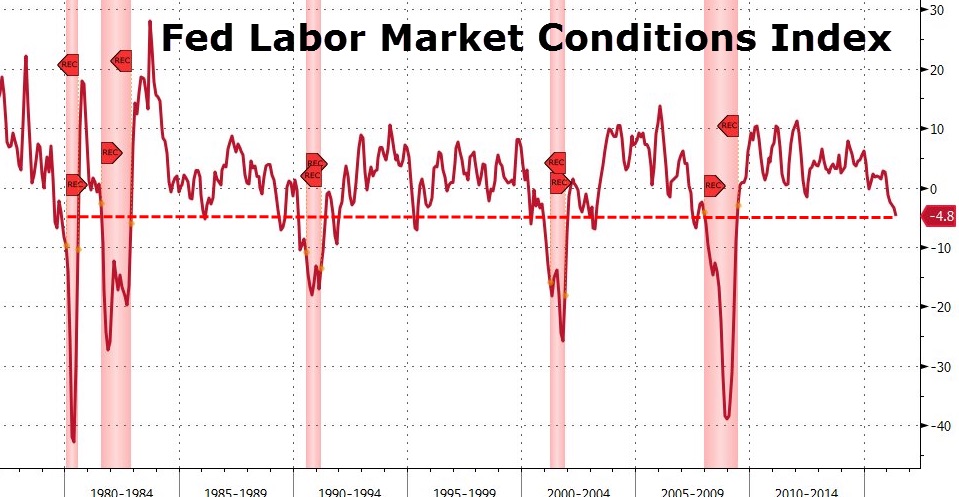

#3 Fed Labor Market Condition Index crashes

In 2014, Chairman Yellen, head of our central economic (or is that comic?) planners, said,

Federal Reserve Board staff developed a labor market conditions index from 19 labor market indicators…. This broadly based metric supports the conclusion that the labor market has improved significantly over the past year. (Zero Hedge)

Not wanting to admit the Fed’s recovery has failed, Yellen said this month that the Labor Market Conditions Index is “experimental.” It’s not saying what they want, so now it is relegated to the “experimental” box because it now looks, frankly, horrible. It has moved rapidly from slightly positive at the start of the year to a -5 at present, its worst level in years.

As you can see, the last time the Fed’s LMCI dipped this low we were just entering the Great Recession. The time before that, we were about to enter the dot-com bust. Drops to this level usually indicate we have just started a recession or are about to enter one. If you look closely at the chart above, you can see that the LMCI began to dive at the end of 2015 when the Fed made its first minuscule tug back on the stick to raise interest rates.

#4 Wages are falling again, too

Lance Roberts writes on his Real Investment Advice that the Fed has found the end of the road:

Despite the rhetoric of stronger employment and economic growth – plunging imports and exports, falling corporate profits, collapsing manufacturing and falling wages all suggest the economy is in no shape to withstand tighter monetary policy at this juncture.

Of course, if the Fed openly suggested a “recession” could well be in the cards, the markets would sell off sharply, consumer confidence would drop and a recession would be pulled forward to the present

The Fed cannot come out and say we are entering a recession because that would be a self-fulfilling prophecy. Roberts points out that the Fed has just released its lowest projections for future US GDP since 2012. To make matters worse, the Fed’s projections notoriously overshoot reality.

The Fed has said many times that the final sign of a solid recovery they are looking for is a rise in wages. So, the fact that wages started dropping almost as soon as they appeared to be rising has to leave Fed board members feeling a little queasy about pitch and yaw in the Recovery’s flight.

Adjusted for inflation, wages dropped 0.1% in April and remained completely flat in May.

#5 The jobs that have been added under Obama have been worse than the jobs they replaced

As Zero Hedge reported, the US added a net 455,000 waiters and bartenders since the close of 2014 while it lost a net 10,000 manufacturing jobs.

A longer-term look at the change in employment demographics since the start of the Great Recession reveals that the number of waiters and bartenders has risen by 1.6 million while the number of manufacturing workers has dropped by 1.5 million — almost an equal displacement.

As I have reported a couple of times, the number of new immigrants during Obama’s reign is roughly equal to the number of new jobs added under Obama, so guess where all of the new lower-pay8ng jobs have gone as Americans who had better jobs have been continually exiting the work force (probably because they’re not willing to take the pay cuts necessary to get these new jobs). The peasant economy is recovering, as is the wealth of the top 10%. The American Middle Class was kicked off the plane, debarring through the tail door while immigrants boarded through the front door, whether they had tickets or not.

The problem got worse in May, which saw a broad decline in jobs that spread negative changes across half of the job sectors measured. Most of the actual job gains that made up May’s paltry job gains came from Obamacare. 67,000 mostly government jobs were added under Education and Health. 13,000 were added under Government. 11,000 under Leisure and Hospitality, and the Finance world did OK with a gain of about 9,000 while Manufacturing, Wholesale, Mining and Logging, Construction and Temp Help all saw losses. Information, which would be include the computer industry, also saw large losses. Healthcare jobs, however, gained enough to pull the net job figures from what would have been a loss in May to the meager reported gain of 38,000 jobs.

May saw a net loss of 59,000 full-time jobs and a net gain of 118,000 part-time jobs, which are counted with the same weight as full-time jobs.

This time it wasn’t the weather.

In every respect, when you dig through the details, the Fed’s job report card gave the Fed a grade “D” for “Dismal.” In the face of that, there was not a chance in the world the Fed’s flight crew would find themselves able to raise interest. They can crow all they want about how they’re going to in order to try to maintain the illusion of recovery, but their dashboard is blinking a lot of red lights. The stall buzzer is screaming, and the altimeter for jobs is rapidly falling now that growth has gone negative compared to the needs of the growing work force.

If Janet is yellin’ anything, it’s “Grab the golden parachutes!”

I would love to say “the Fed is dead,” but I’m afraid the monster at the helm lives on. Even though its recovery is falling out of the sky, hope dies hard. The failure of its fake recovery should cause the Fed’s own execution for having brought all of this upon us with its policies of sloppy debt enticements and its bizarre notion that an economy can be built over an ever-expanding pit of debt — a core idea so obviously stupid that it’s hard to believe the Fed can convince so many seemingly smart people to buy into it; but buy into it they still do … in spite of rampant signs of failure everywhere in the world now and in spite of the fact that its policy of saving the nation economically has only enriched the rich. We all know that, but we let them fumble on in the cockpit, blindfolded by their own ideas.

The post Why Janet Ain’t Yellin’ “Higher Interest” Anymore: Jobs Worse than Expected and Far Worse than Reported appeared first on crude-oil.top.