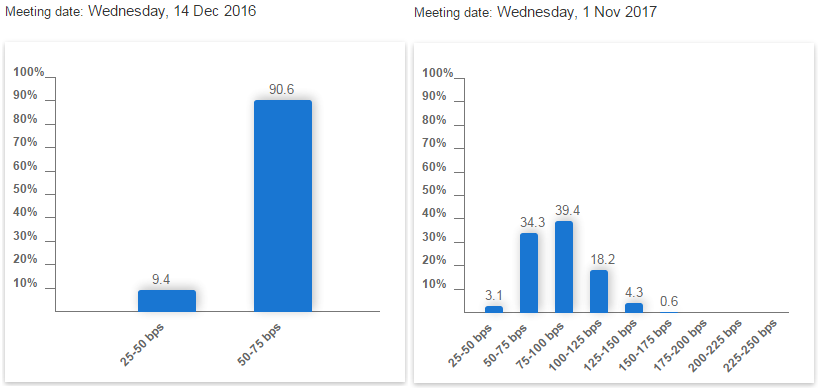

Financial markets may have all but priced in a rate hike from the Federal Reserve in December but Donald Trump’s election victory has slightly altered the conversation among traders from the timing of the next move to the pace of tightening going forward.

Ambitious spending plans from the President-elect has posed a problem for the central bank that it has not had in some time, the need for rates to rise faster in order to offset the likely rise in inflation. The Fed has been keen to be slightly ahead of the curve in order to avoid the need to raise rates faster when inflation does pick up and risk choking of the recovery or even risk throwing the economy back into recession.

USD/JPY – Yen Hugs 109, US Inflation Report Next

We may get some insight from Chair Janet Yellen today on how the central bank will deal with the anticipated inflation and whether she believes a faster pace of tightening will be required next year. The markets may have priced in December but as of yet, only one hike is priced in for next year which strikes me as being too few under the circumstances, even not accounting for Trump’s spending plans.

Source – CME Group FedWatch Tool

Should Yellen hint at the need to raise rates more next year then we could see the dollar extend its recent gains having already hit thirteen and a half year highs on Wednesday. That could see Gold come under pressure once again having managed to stabilise in recent days following a big post-election sell-off. Gold continues to look vulnerable to the downside, with $1,200-$1,210 being the next major support and Yellen could hold the key to when this will give way.

First Brexit, Now Trump, is Italy Next?

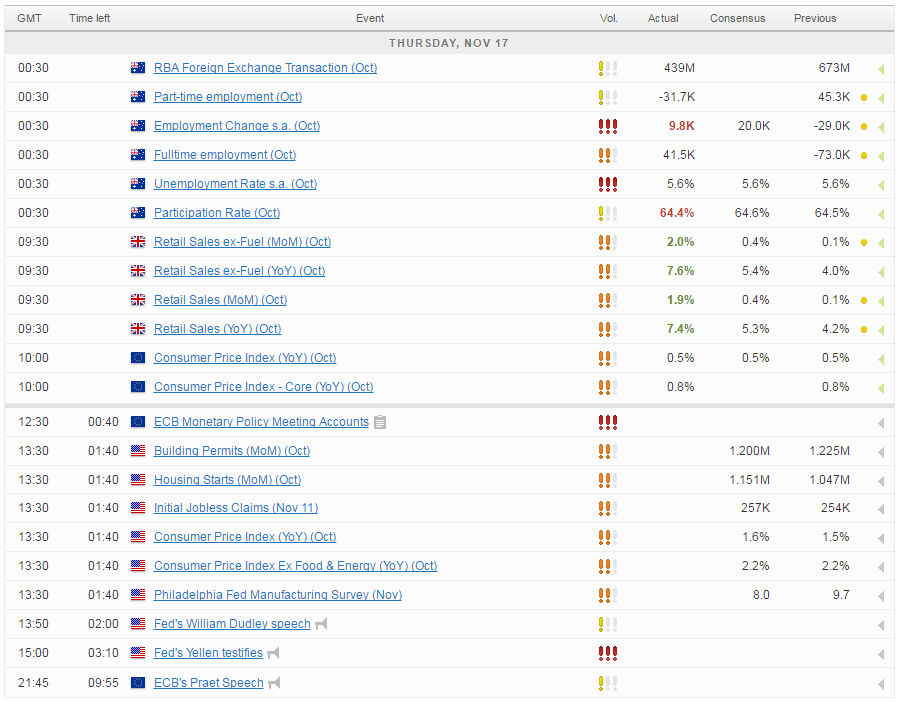

We’ll also hear from William Dudley and Lael Brainard today, two other permanent voting members of the FOMC, which could drive some dollar volatility. CPI inflation data will be released ahead of these appearances which could provide some added interest given that the core reading surpassed the Fed’s target earlier this year and has been slightly above ever since. Obviously the Fed’s preferred measure, the core PCE price index, lags behind this but another rise in the CPI may suggest we’ll see a similar rise in the former in a couple of weeks.

For a look at all of today’s economic events, check out our economic calendar.