Sentiment improves even as China GDP disappoints

European equity markets are poised for a more positive open on Friday, buoyed by the gradual improvement in Asian markets overnight following a shaky start.

Sentiment across the globe has remained cautious at best this week but all things considered, I think investors will be heading into the weekend somewhat relieved. If this time last week – when investors were weighing up the potential fallout of a couple of really bad days for the markets – you offered them a somewhat shaky week but one that ended roughly where it started, they would have snapped your hand off.

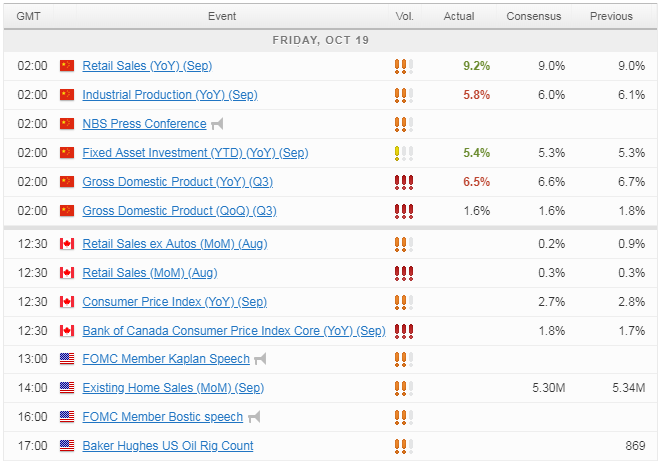

Chinese data over night threatened to sour things heading into the weekend, with growth in the third quarter slipping to 6.5% from 6.7% and missing expectations. And that was certainly looking the case early on but perhaps the better than expected retail sales and fixed asset investment numbers, as the government looks to support the faltering economy in the face of US tariffs, offset the GDP disappointment. This was accompanied by offers of support for non-state backed listed company’s from the central bank and others, which likely eased concerns about the recent slowdown and stock market declines.

China offers verbal support as growth hits lowest in nearly a decade

Positive tones coming from Brussels as May offers another concession

Theresa May’s Brussels visit may not have been the complete waste of time it was looking even 24 hours ago, with leaders suddenly sounding more optimistic that a deal can be reached. It would appear that May’s transition extension proposal has sat better with Brussels than it inevitably will do in London, with some of the more staunch Brexiteers already voicing their disdain for such a move.

Still, these are the sacrifices that the PM is consistently being forced to make in order to progress talks and avoid a no deal Brexit, something some of her louder colleagues at home don’t have to worry about. With time running out though, I struggle to see how this really resolves the problem of the Northern Irish border and the backstop unless further concessions are made. The EU may now have a reputation for eleventh hour deals but as the deadline nears, traders are not going to bank on another and the nerves will start to creep in.

Asia Market update: China data

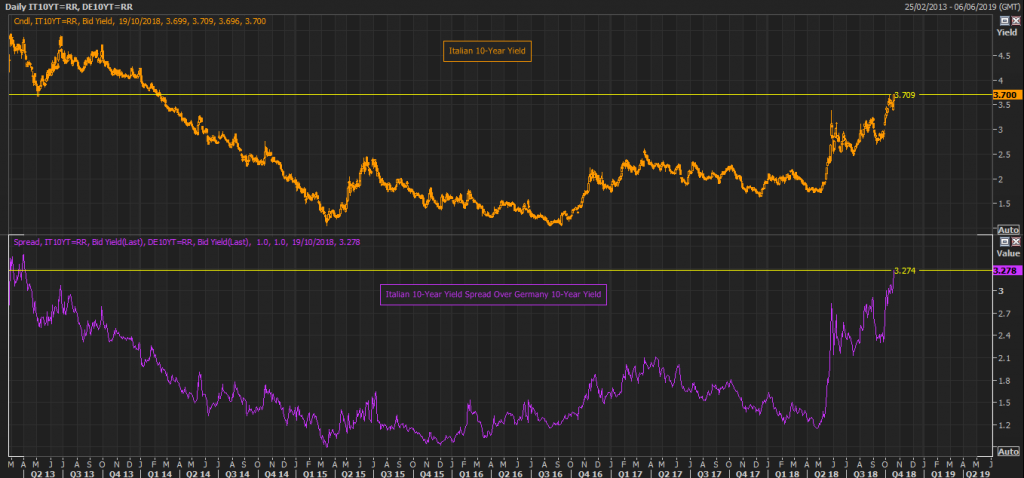

Italian borrowing costs his four and a half year high as budget talks begin with Brussels

As if Brexit isn’t enough of a headache, the EU has another fight on its hands as the populist coalition government in Italy attempts to circumvent the blocks budget rules in order to follow through on campaign promises that are, unsurprisingly, much easier to make than deliver on.

With discussions now underway and Italy having until Monday to respond to the European Commission’s concerns about its budget plans, both sides would be wise to not let this get heated. Brussels will want to avoid providing bait to the eurosceptics while the government will have one eye on the bond markets at all times, with Conte already in discussions with the ratings agencies in a desperate attempt to avoid a downgrade.

That would be catastrophic for the government’s plans and would likely trigger another spike in its borrowing costs, with the 10-year yield already at a four and a half year high and the spread over Germany at a five and a half year high.

Italy 10-Year Yield

Source – Thomson Reuters Eikon

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.