The Bank of England meets on Thursday, a meeting that has come back to the forefront of investors’ attention over the last few months following the UK’s vote to leave the European Union.

Prior to this, the Bank of England had held interest rates at 0.5% for seven and a half years and there had been no increase in quantitative easing – central bank bond purchases – since July 2012.

This all changed with Brexit and rather than the next move being a rate hike 12-18 months down the line, the Monetary Policy Committee was forced to announce further stimulus measures at the meeting in August.

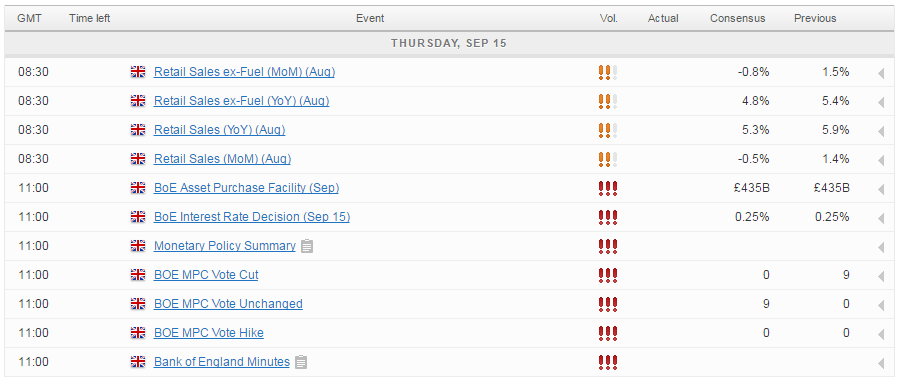

These consisted of:

- 25 basis points interest rate cut to 0.25%

- £60 billion increase in bond purchases to £435 billion

- £10 billion in new corporate bond purchases

- £100 billion Term Funding Scheme

Since then the economy has fared better than the initial surveys indicated and while the economy is expected to slow in the coming quarters, a recession may be avoided, in part due to the response from the BoE.

The result of this is that the BoE is unlikely to announce further stimulus measures at the meeting this month and despite warning that further rate cuts will likely follow this year if the economy performs in line with expectations, it is not guaranteed at this stage.

With the minutes and votes now being published alongside the rate announcement, it will be interesting to see whether there is much desire for further stimulus measures, either today or before the end of the year. This will likely have the greatest impact on the pound, the FTSE and UK debt.

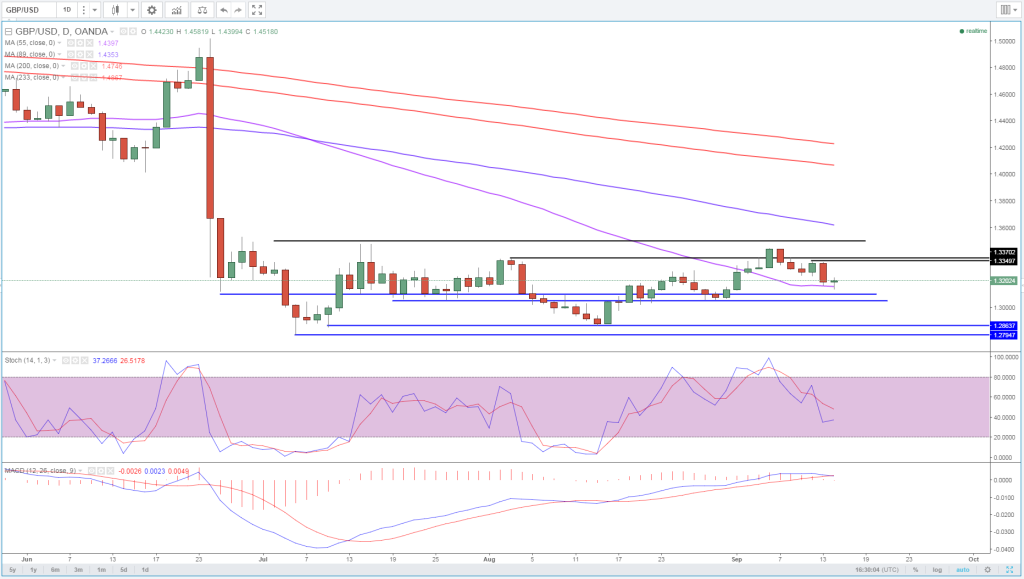

The pound has recovered off its lows since the start of August, in part driven by the recovery in the data. It took a hit earlier this week when the CPI data for August did not rise as expected, triggering a belief that lower inflation could encourage the BoE to announce further stimulus.

Should the minutes indicate that further measures may no longer be necessary this year then we could see the pound push higher, which could in turn weigh on the FTSE due to the negative correlation between the two. A suggestion that further bond buying won’t happen in the near future could also weigh on Gilt prices which would mean higher yields.

To view our video on the upcoming BoE policy decision, click here.

For a look at all of today’s economic events, check out our economic calendar.