By EconMatters

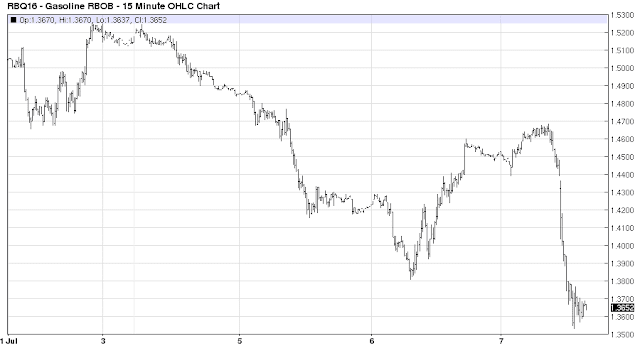

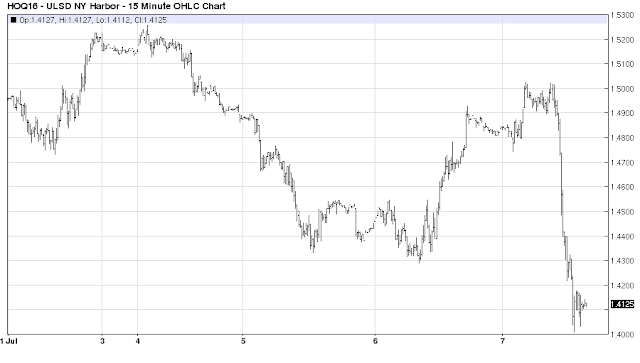

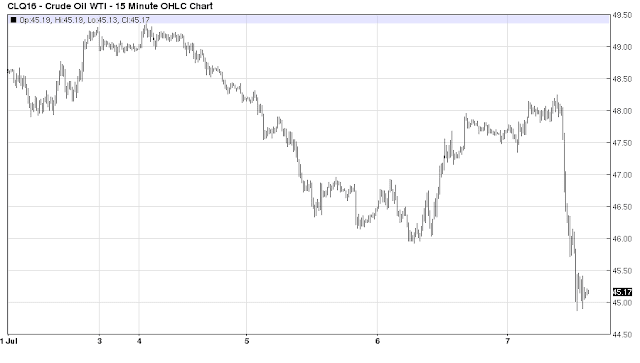

The API set the expectations bar high for today`s EIA Report, and the Gasoline numbers came in well below the API numbers from last night. Gasoline is what shorts have been concentrating on in the year over year comps, up around 20 Million versus last year. The actual demand numbers are fine, it is just going to take some time to work off these gasoline inventories as the market goes through the rebalancing process.

Basically, a lot of Oil was pushed through the system in terms of refined product just to get it out of oil storage inventories, refining for the sake of refining, regardless of need. We have seen this play out in Asia and Europe as well, but the good news is that consumers are buying more gasoline, driving more, and economics is playing out as it should in the oil market. Thus the oil market will eventually rebalance, and at some point move into deficit supply/demand dynamics.

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

The post EIA Petroleum Report Analysis 7-7-2016 (Video) appeared first on crude-oil.top.