Inflation and Retail Sales Data Eyed Markets Gradually Stabilize

US futures are pointing to a stronger open on Wednesday, building on the small gains posted at the start of the week and offering some hope that stability is slowly returning to the markets.

Given the volatility that we’ve seen over the last week or so, which was initially attributed to higher interest rate expectations following the January jobs report, traders will be closely monitoring the US inflation and retail sales releases today. Both numbers will be released shortly before the open on Wall Street and could be the trigger for further volatility, especially if the CPI exceeds expectations.

While the CPI number isn’t the Federal Reserve’s preferred inflation measure – which could impact how traders respond to it – it is released a couple of weeks earlier than the core PCE price index and so is seen as being indicative of inflationary trends. This means markets can be sensitive to the release, particularly during times of increases sensitivity, like we’re seeing at the moment.

DAX Gains Ground on German, Eurozone Growth

Markets Still Appear Vulnerable to Downside Shocks

Volatility has remained since the initial spike last Monday although the VIX has more than halves since then, so things are calming down a little. That said, investors still appear jittery and equity markets remain some way off their highs. Yields are back at last Monday’s levels and have pushed above them in recent days so this blip hasn’t had any lasting impact on medium-term interest rate expectations, although that could change if we see further episodes.

The dollar has been one of the beneficiaries of the recent volatility, with the increased US interest rate expectations lifting the greenback off its lows after months of significant downside pressure. The dollar index rose briefly above 90 late last week before some profit taking set in and while it remains vulnerable to further selling, I wonder whether we’re going to see more of a bounce in the near-term, particularly if we get some decent numbers today.

US Dollar Index (Reuters) Daily Chart

Source – Thomson Reuters Eikon

Will it be a Valentines Day Massacre for the Dollar?

Bitcoin Making Steady Gains But More Pain May Lie Ahead

Bitcoin has been making steady improvements over the last week, having fallen below $6,000 briefly, roughly 70% from its high reached in December. While cryptocurrency enthusiasts will be encouraged by the period of stability in price and gradual gains during that time, I think it still looks vulnerable to near-term pain before a bottom can be claimed.

I think $9,000 to $10,000 will pose some real challenges for bitcoin but if it can overcome these levels, it will be a very encouraging sign for those bullish on the cryptocurrency. Negative news flow has been a major test for bitcoin so far this year and if that keeps coming, I struggle to see how it can gain any real upside momentum.

Bitcoin (CME) Daily Chart

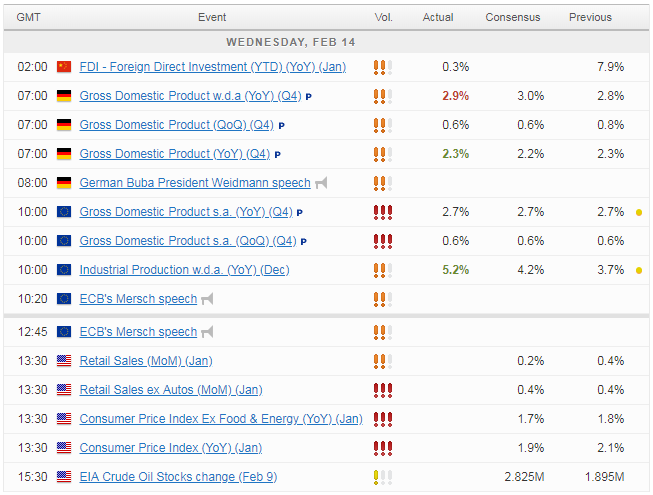

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.