Submitted by Adam Taggart via PeakProsperity.com,

Take a moment to reflect on all the people you care about who aren't reading this article. Or sites like this, which wrestle with the implications of limits to growth and the concerning unsustainability of the economic and natural systems our society depends upon.

How many of your family members, good friends, and neighbors simply choose to ignore the messages from those of us alarmists on the "doomer" side, and live life trusting that tomorrow will always look and feel pretty much like today? Most of them? All of them?

Look, it's understandable. Humans aren't wired well to respond to future risk that isn't visible as an immediate threat. And temperamentally, we prefer good news over bad, so we seek to overweight the former and discount the latter. Who wants to stress out about what "might" happen tomorrow, anyways — can't we just enjoy life today?

The rift between the preparedness-minded and those not is age-old, as fables like Aesop's The Ant & The Grasshopper date at least as far back as the 5th century BCE.

We spend our focus on this website engaging the "ants", the empirically-minded folks who look at the data and concur that there is sufficient possibility of one or several crises (economic, energy-related, environmental — or a combination of such) occurring in the next several years. And that taking advance action is prudent.

But the ants are the minority.

Forget about planning for the more esoteric risks posed by faulty monetary policy or energy economics — 72% of Americans don't even have a basic emergency response kit in place should an ordinary kind of disaster strike (power outage, hurricane, tornado, earthquake, etc).

The simple reality is that, if you're investing your energies towards building resilience against potential hardship, most of those around you likely aren't.

In the midst of your efforts, are you planning for their lack of preparedness?

Grasshopper Nation

The data shows us that the vast majority of Americans are not ready to deal with even minor setbacks.

In January of this year, Bankrate.com released survey findings that revealed that only 37% of Americans would be able to cover an unexpected expense (e.g., auto repair, medical bill) of $1,000 with savings. The remaining 67% would have to borrow from friends and family, cut spending elsewhere, or use credit cards to come up with the funds.

In March, the Economic Policy Institute published an excellent chartbook titled The State Of American Retirement (for those inclined to review the full set of charts on their website, it's well worth the time). The EPI's main conclusion from their analysis is that the switchover of the US workforce from defined-benefit pension plans to self-directed retirement savings vehicles like 401Ks and IRAs has resulted in a sizeable drop in retirement preparedness. Retirement wealth has not grown fast enough to keep pace with our aging population.

The stats illustrated by the EPI's charts are frightening on a mean, or average, level. For instance, for all workers 32-61, the average amount saved for retirement is less than $100,000. That's not much to live on in the last decades of your twilight years. And that average savings is actually lower than it was back in 2007, showing that households have still yet to fully recover the wealth lost during the Great Recession.

But mean numbers are skewed by the outliers. In this case, the multi-$million households are bringing up the average pretty dramatically, making things look better than they really are. It's when we look at the median figures that things get truly scary:

Nearly half of families have no retirement account savings at all. That makes median (50th percentile) values low for all age groups, ranging from $480 for families in their mid-30s to $17,000 for families approaching retirement in 2013. For most age groups, median account balances in 2013 were less than half their pre-recession peak and lower than at the start of the new millennium.

(Source)

The 50th percentile household aged 56-61 has only $17,000 to retire on. That's dangerously close to the Federal poverty level income for a family of two for just a single year.

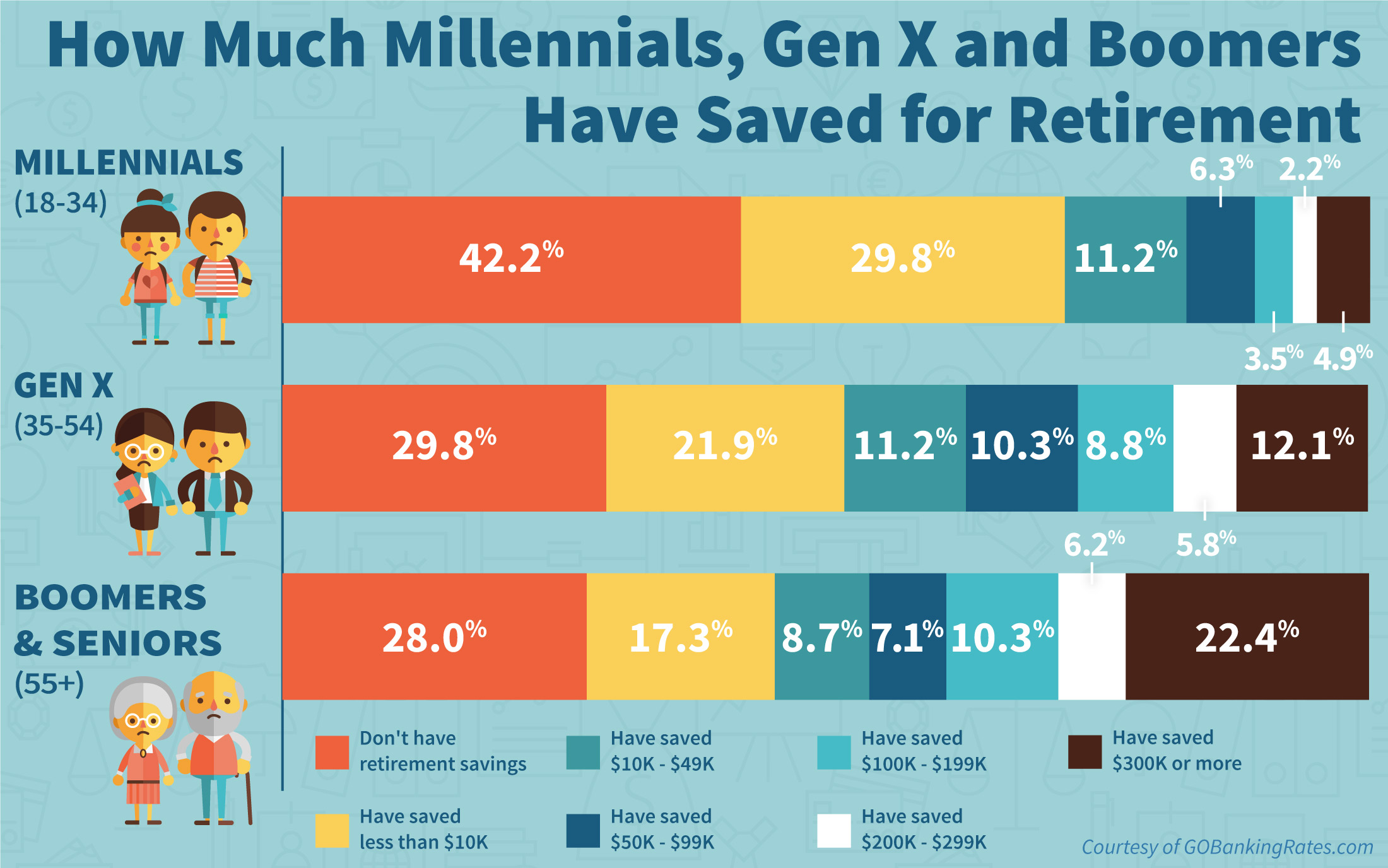

Another survey breaking out retirement savings by generation shows that as unprepared as many Boomers are, their savings rates dwarf those of Gen X and Millennials. True, Boomers have had more decades to accrue money, but challenges to capital formation are also responsible in large part — e.g. lower real household wages, higher cost of homes and other living expenses, and early-career portfolio losses from the 2008-2009 market crash:

(Source)

The result? 56% of all adult Americans have less than $10,000 saved for retirement.

When it comes to saving for the future, we are a nation of grasshoppers

But Wait, It Gets Worse

The statistics cited so far are depressing on their own. But what if American workers' ability to save gets further compromised from here?

There's a litany of reasons it very likely will. Here are just a few:

Declining Civilian Labor Force Participation Rate

Despite the manic (and wholly unbelievable) headline unemployment rate number released by the government, the real underlying story of US employment is one of a shrinking potential workforce.

We were treated to a most-egregious dose of BS from the BLS (Bureau of Labor Statistics) just this morning in the Non-Farm Payroll Report, which showed the unemployment rate falling to a shockingly fantastic 4.7%. Amazing, right? What a recovery our central planners have pulled off!

But when you look at the underlying data, it's not a growing amount of jobs that's the main driver of this low rate. Rather, it's the decline in the pool of bodies deemed as 'eligibile workers'. You see, after folks have been out of work for a certain length of time, the government gives up on them, and re-classifies them as permanently unemployable. Some of this is understandable: the boomers (who can) are beginning to retire. But as friend-of-the-site Dan Amerman has calculated, 74% of the jobless who have been removed from unemployment calculations are in the 16-54 age bracket. So, we are looking at a situation in which the government is subjectively choosing whom to count and whom to not count.

The percentage of the US adult population counted as potentially employable has been declining since the start of the new millennia, and gathered steam after 2008. How many people is the US government now counting as "not employable"? 95 million — an all-time record:

(Source)

Think about that for a moment. Our government is telling us that 95 million adults — nearly 1/3 of all the people living in the United States — are such hopeless prospects that we should simply forget about them ever working again.

Of course, removing these people from the official record allows administrations to trumpet rosy statistics like the 4.7% unemployment rate we saw this morning. So if they can get away with it, you can bet they will.

Until we start pushing back on such devious manipulation of the facts, we're just fooling ourselves as a society. Any cheerleading of the current chicanery just takes our eye off of the really important, and massive, structural problem: we have a ridiculously high number of our adult citizens who can't find gainful employment.

Layoffs & Automation

I've written at length recently about two other factors that will make it hard for today's workers to build retirement capital: layoffs and automation.

So far 2016 is setting a 7-year high in terms of reported layoffs. My earlier article Mass Layoffs To Return With A Vengeance explains how that trend is likely to accelerate from here, and why having a Plan B in place before receiving a pink slip is a particularly sound strategy right now.

My more recent report Automating Ourselves To Unemployment examines the powerful incentives businesses both large and small have right now to replace human capital with technology. Yes, this has happened throughout history — but never at such scale and such speed. And it's important to remember that once industry invests in automation technology, the jobs displaced never come back. Displacing a large percentage of human labor without a plan in place to put that displaced labor to productive use is a sure-fire recipe for long-term crisis. Our current trajectory has us hollowing out our workforce at an alarming rate. Unskilled labor needs a place of entry in order to build skills and work experience. Yet we are closing that door.

Disruptions In Financial & Energy Markets

Websites like this one publish numerous articles each week detailing the extensive reasons why a 2008-style correction (or worse) in the financial markets is likely overdue. A world economy awash in too much debt. Asset prices bubbles blown by excessive central bank liquidity. A weakening global economy. Stumbling corporate earnings.

This week? We learned that the CAPE Ratio is back at its 2007 overvalued heights. So many bubbles. So many pins…

The EPI chart above showed us that US retirement savings have yet to recover from the losses experienced during the Great Recession. How long will it take them to recover from the next major market correction? An additional 'lost decade'? Longer?

And on the energy side, the US economy is still reeling from the collapse of the shale 'miracle'. Times get tough when prices collapse: companies bleed red, and layoffs ripple through the oil & gas industry and the many other industries that service it.

But times may well get even tougher in the next chapter of this story. Right now, infrastructure is being shut down and sold off (the US oil rig count dropped from 1,600 to 400 over 2015 according to Baker Hughes). But total world oil consumption is still growing. When the current excess of oil stores is used up, we are very likely to experience a petroleum shortage before incremental supply can be brought back online. Remember those days of $100+ per barrel oil? We may be back to them sooner than you think. And with that, all of the associated price inflation in the cost of living that a higher oil price brings with it.

How Will The Unprepared React?

So — lots of reasons to expect the vast majority of the population to be vulnerable to coming crises both large and small. When the next calamity strikes, how will these people likely react?

History gives us plenty of examples to answer this with confidence: Not well.

When resources per capita drop below a certain level on Maslow's Hierarchy Of Needs, civility is thrown aside. Desperate people act desperately.

We've heard examples of this from past podcast guests like Fernando "FerFAL" Aguille, who lived through several economic collapses in South America.

Closer to home, it took less than 24 hours for stores shelves to be emptied and fights to break out over water after a water main broke in Weston, MA, a suburb of Boston, in 2010.

But perhaps this classic episode from the Twilight Zone best captures the jettisoning of social mores in the face of unexpected crisis.

Filmed during the Cold War, this short episode captivatingly dramatizes how quickly our social fabric can rip apart when unexpected threats arise. Specifically, it shows how the unprepared are likely to turn to — and then, on — those who did take precautions:

It's worth taking the time to watch this episode. It really hits home the importance of having extra supplies on hand for the inevitable 'unprepareds' banging on your door should a disaster arrive.

And it raises the critical questions:

- Of the people in your life, which ones will you put aside reserve resources for?

- How much are you willing to put aside for them?

- And, what are your limits? At what point will you say "no"?

Preparing For The Unprepared

Our resources are finite. Most of us don't feel we have all that we require to meet our own needs and goals. And the best-laid preparations of the most planful of us can suddenly become woefully insufficient if too many unexpected family, friends and neighbors show up demanding our charity.

How do we prepare for the unprepared?

The short answer is we can't; not fully. But we can plan for how much to place in reserve for them.

Here at PeakProsperity.com, we firmly believe in helping others; even those who scoff today at our "doomer" approach of preparing for the worst. But we realize that the demand from the unprepared masses during a crisis will most likely always dwarf your resources. So you'll have to make tough calls. Our advice is to make them now. Whom will you help? What are you willing to provide them with?

Making those choices is heartbreaking. But making them now allows you — as well as your loved ones — to better prepare today by setting expectations and creating specific goals.

Here's our advice for those of you wrestling with this thorny task:

- Put your oxygen mask on first — You can only be a help to others if you're first in a position to do so. It all starts with building resilience; reducing your vulnerability to the highest likelihood threats able to impact your lifestyle the most (job loss, market crash, sustained power outage, natural disaster, health issue, etc). Our book Prosper!: How to Prepare for the Future and Create a World Worth Inhering was created as a manual for doing exactly this. And its companion What Should I Do? Guide provides step-by-step guidance for a making your preparatons (be sure to start with Step 0)

- Serve as a model — Let your actions be visible as an inspiration to others. Allow them to see that preparing for the unexpected isn't just for the "tin foil hat" crowd. Emergency preparedness investments like stored food and water don't need to break the bank, can be made over time, and can involve the entire community in activity that brings it closer together. Building Social Capital, improving your health and fitness, learning new skills, becoming more energy efficient, learning to strengthen your emotional health and those you care about — all of these are life-enhancing pursuits.

- Keep your reserve assets confidential — Don't make ALL of your preparations known. As the above section shows, desperate people take desperate action. The best way to guard against folks coming to take your most precious assets is for no one to know they exist. Beyond that, it often helps to have protective measures in place. Our Personal Safety & Home Defense Guide is full of advice on how to reduce your exposure to the most prevalent forms of invasion and attack.

- Build awareness among friends/family of the risks in play — Forewarned is forearmed. Our video series The Crash Course was created to build awareness of the macro risks we face today, and to explain them in an intuitive, approachable way to people of all backgrounds. Sharing that series (or the more condensed 1-hour Accelerated Crash Course) is an excellent way to open eyes and minds to the need for prudent action today. Again, use our What Should I Do? Guide as a catalyst for helping those who 'get it' take their first steps.

- Get folks engaged in the right actions for the wrong reasons — So your buddy next door doesn't want to hear about your "doomer" predictions? Try a different tact. Maybe he likes the idea of a neighborhood fall cider pressing party, and joins you in planting a few apple trees in each of your backyards. Our Community Building guide is full of ideas for engaging your neighbors in action in ways that make your community more resilient, even if they don't realize it through the fun they're having.

- Define your line — Let those whose welfare you're taking into consideration know of your intentions. Don't make it a guarantee; just let them know their security is important to you. But let them know now what the limits of your support will be — or even better, give them a more restricted version (which will leave you some buffer in case of the unexpected). Setting these expectations in advance is valuable, even if the folks you're talking to aren't really listening. At the very least, you can proceed knowing you've done your utmost to be up front about what they can and can't count on you for. Review our guide on Emotional Resilience; you will very well need it to prepare your heart in case you ever do have to put these tough calls into action.

- Empower the latecomers — Invest in assets and agreements that enable late-arrivals to help themselves (tools, information/education, small jobs, etc). Helping people skill-up and provide for themselves both increases their ability to prosper and reduces the likelihood they drain your finite stores. And you'll be perceived as a benefactor within your community, which will be motivated to provide for and protect you (rather than abandon you) during times of adversity.

There's no doubt this is a thorny subject, with imperfect answers. But to fail to plan for the needs of the unprepared is, in itself, a plan to fail. After all: it's a grasshopper nation, and we ants are too few.

The post Grasshopper Nation: Planning For Those Who Aren’t Prepared appeared first on crude-oil.top.