Authored by David Hay, via EvergreenGavekal.com,

"Low interest rates cause secular stagnation: they do not cure it.” -CHARLES GAVE

“Negative interest rates are the dumbest idea ever.” -JEFF GUNDLACH, the new “King of Bonds”

“Laugh but listen.” -WINSTON CHURCHILL, addressing the British House of Commons, warning it once again of the rising threat posed by Nazi Germany, to derisive laughter.

SUMMARY

- Overwhelming amounts of government debt are among the “rich” world’s biggest threats. Unfortunately, the political will to cope with this—and the related problem of runaway entitlement spending—is nil.

- Radical monetary measures—such as quantitative easing (QE), plus zero- and negative-interest rate policies (ZIRP and NIRP)—are not stimulating growth. Instead, they are producing stagnation, “lowflation”, deflation, and currency wars.

- However, they have stopped the ticking of the debt bomb. They are also reversing the disadvantaging of younger generations at the expense of the older and wealthier; the latter are the big losers from the eradication of interest rates.

- Investors need to adjust to ZIRP and NIRP. They are likely not going away anytime soon.

- These also make it less probable the US government will resort to high inflation as a form of “stealth default” on its immense debt.

- Central banks printing money to buy government bonds is supposedly the pain-free way to extinguish crushing debt burdens. However, there is no free lunch.

- Monetary authorities are finally realizing QEs, ZIRPs, and NIRPs, are failing to catalyze growth. Discussions about banning high-denomination currency (like $100 bills) are gaining steam as is a debate about the merits of doing “helicopter” money drops (direct money transfers to citizens).

- The Fed suspending its rate normalization scheme (after just one hike!), and the European Central Bank unveiling a raft of extreme easing measures, have triggered rallies in almost everything since early February. Energy, Canadian REITs, and gold mining stocks have been by far the stars.

- US stocks are still trading way above the trend-line growth rate of the economy (GDP). There is always reversion back to that and even below.

- Not trying to be Davey Downer but if things are fine why are QEs, ZIRPs and NIRPs necessary? And why is the US middle class so despondent?

- There are a growing—and disquieting—number of parallels with the 1930s, though, also many differences.

- Some good news: in addition to zero interest rates and tepid growth forestalling the day of debt reckoning, they may be creating a trading range market. Perhaps a vicious bear episode can be avoided, or at least delayed.

- However, investors need to be nimble and contrarian. It’s imperative to overweight those areas—like energy-related last year—where money is fleeing en masse. A passive 60/40, stock/bond, portfolio won’t produce the kind of returns investors desperately need.

The best laid plans…

One of the most pressing questions of our time simply must be: How will the developed world cope with its ever-growing mountain of debt? Despite what some have erroneously called The Great Deleveraging, recent years have seen the global mass of liabilities continue to swell at a rate that puts the continually-erupting Kilauea volcano on Hawaii’s Big Island to shame. If that seems exaggerated, consider that nearly $60 trillion has been added to what was already a towering heap of IOUs since 2007.

Not long ago, fears of this dominated the thinking of policymakers, economists, and even regular mom and pop investors. The existential threat from this debt explosion was admirably addressed several years ago by a bipartisan piece of proposed legislation: Simpson/Bowles. Oh, yeah—remember that blast from the past? The only problem is that it was not just in the past, it also never passed.

But here’s the rub: maybe it didn’t need to be; maybe we’re better off without it. Before long-time EVA readers think I’ve taken leave of what senses I still possess, please allow to me to explain (which is emphatically not to endorse). The period since the Global Financial Crisis—the worst modern economic and market calamity other than the Great Depression—has seen the world’s leading central banks engage in ever-more “creative” strategies to reignite growth and, ironically, inflation. The irony is that for most of their existence, entities like the Fed were continually battling too much inflation, not too little. Further amping up the ironic meter is that trillions and trillions of money fabricated by central banks has created “lowflation” and even deflation.

As many EVA readers know—but few can comprehend—increasingly desperate inspired central bankers have, in recent years, resorted to negative interest rate policies (NIRPs). Ostensibly, these have been implemented to catalyze economic growth. Yet, much like zero interest rate policies (ZIRP) and the now infamous quantitative easings (QEs), the evidence on the ground—as opposed to the academic ivory towers—is that these have almost no positive impact on GDP growth. This is even according to a recent Fed study!

And when it comes to inflation, NIRP, ZIRP and QEs have all been factors in bringing back that dreaded vestige of the 1930s: currency wars. As these competitive currency devaluations have spread around the globe, they have created declining commodity and import prices—at least for those countries that have fallen behind in the debasement cycle.

When this happens, a country (like the US over the last year-and-a-half) begins to run a larger trade deficit. Its companies have a hard time selling their products and services, putting downward pressure on earnings. This typically leads to layoffs and, if severe enough, can cause a recession. You may have noticed (and we’ve tried to help in that regard!) that the US corporate sector is almost certain to have endured three straight quarters of falling profits. Even two in a row is considered an earnings recession.

For awhile, the stock market seemed quite agitated about this outcome. Lately, though, with the Fed at least temporarily halting its official tightening cycle after the heroic move of one lone increase, and the European Central Bank going nuclear on its easing measures, stocks have bounced back close to their highs from last summer. As you may recall, this was right before the August “crashette” that saw the Dow fall 1100 points in less than an hour.

Let’s stop for a moment and recap what these lords of the financial kingdom have wrought…

Paradise (accidentally) found?

Ok, so thus far, ZIRP, NIRP, and “From Here to QE-ternity” monetary policies have given us:

1. The worst economic expansion in modern history.

2. The lowest interest rates since the Middle Ages, if not antiquity.

3. Falling inflation-cum-deflation.

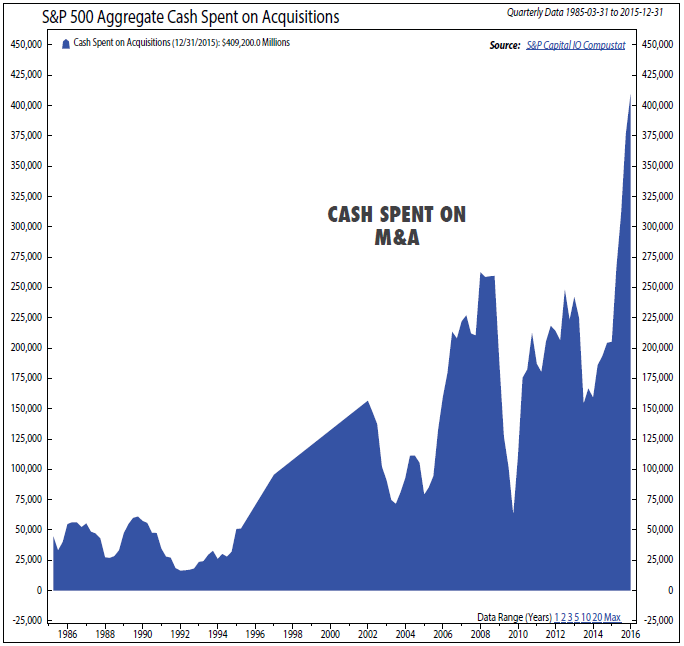

4. Corporations around the world leveraging up to acquire other companies (and, of course, instituting mass layoffs once the deals go through) and buying back their own stock. These have come at the expense of normal levels of capital spending.

5. Related to 4, and the “cap-ex” plunge, we’ve seen a collapse in productivity which is essential for economic betterment, particularly in aging societies

6. Asset bubbles in everything from collector cars to penny stocks to Manhattan penthouses to, Seattle apartment buildings, to…well, you name it, and the central banks have almost certainly inflated it; many now appear to be leaking oxygen at a steady, if not rapid, rate.

Notice there aren’t any opinions in the foregoing half-dozen points, just observations. You don’t have to have a PhD in economics (in fact, it would probably help if you didn’t!) to realize these ZIRP/NIRP/QE dogs won’t hunt. But, remarkably, this insular group of brainiacs—whom Jim Grant calls the Monetary Mandarins—believe their pack of hounds will pick up the scent real soon—at least by next year. (Have you noticed that the growth break-out is always going to be next year? Don’t worry that we’ve been hearing that for years…and years…and years.)

But let’s give these clever men—and at least one woman–their due. They have come up with an ingenious way to both fund what is an otherwise bankrupting eruption in entitlement spending at the same time that they’ve solved the disadvantaging of younger generations.

Say what?

Did the debt bomb suddenly stop ticking?

As noted at the outset, any attempt to defuse the entitlement time-bomb has been resolutely ignored by our political leaders (cross out hacks). In this regard, they’ve had plenty of company around the world. Yet, my fellow Americans, the ticking is only growing louder, at least from the standpoint of IOUs accumulating at an alarming rate.

Source: Ned Davis Research

However, the aforementioned angst over being buried alive, when the side of the debt mountain finally shears away, was predicated on a belief in the ever-presence of interest rates. As noted in the March 25th EVA, if governments can borrow for free or—even more incredibly—be paid to issue bonds, there are absolutely no worries.

Now, I’m not at all sure the Fed and its global counterparts intended to solve the debt/entitlement crisis but, at least for the time being, they appear to have done so. They’ve also rectified the indenturing of the younger generations. This is because there are always winners and losers from policy prescriptions like NIRP and ZIRP. Young people don’t tend to hold many assets (if they do, these are unlikely to be bonds). They also often have a mortgage to service. Therefore, the extinction of interest rates is manna from heaven. Moreover, the crushing debt burden they were supposed to inherit from the Boomer generation has become as light to bear as a feather on the surface of the moon.

Obviously, there are also losers from such a radical set of policies and it’s manifestly obvious who they are: Nearly anybody with a portfolio, which includes most EVA readers and yours truly. We are the ones who need to make money off money, something NIRPs and ZIRPs render exceedingly difficult.

In recent months, I’ve been discussing negative interest rates with dozens, if not hundreds, of clients and quite a few non-clients (yes, sometimes, I talk even with them!). What I have heard consistently is bewilderment over why anyone would accept a negative return. As also discussed in the March 25th EVA, there are various reasons, including fears of deflation. But, often, it comes down to another acronym, in this case one that has helped prop up the stock market over the last few years: TINA, There Is No Alternative.

Large corporations in Europe, for example, have little choice but to hold their money with a bank or in the short-term bond market. Thus, they accept a slightly negative yield. Longer term yields—out to almost 10 years—are also sub-zero in much of Europe (and in Japan out to 12 years). This is unquestionably a function of the “print-and-buy-bonds” actions of the European Central Bank and the Bank of Japan. Thus, market rates don’t reflect a true cost of capital but rather one fabricated by central banks.

Regardless, it’s the reality we are facing as investors and we’d better adapt to it if we want to produce any kind of positive returns in future years. For sure, someday this nonsensical era will end. Just don’t hold your breath—unless you want to die of asphyxia.

When you come to a fork in the road, take it!

One of Evergreen’s savviest clients and I discussed the end-game possibilities for this surreal scenario a couple of weeks ago. We came to the conclusion, by no means definitive, that things would follow one of two paths: either inflation going bonkers or a semi-perpetual state of economic paralysis such as Japan has known for over 25 years.

When QEs and ZIRPs first made their appearances (and well before NIRPs reared their ugly head), the assumption was that trillions of dollars of fake money would automatically lead to inflation running wild. As noted above, we’ve gotten exactly the opposite. And, as observed in numerous earlier EVAs (though not lately), the reason is the collapse in money velocity. Per the chart below, you can see that the turnover of money is running at 1930s-type levels, one of many current echoes of that turbulent decade.

Source: National Bureau of Economic Research, Federal Reserve, Bawerk.net

Every time a central bank cranks up the printing press, or lowers rates into more negative territory, velocity tumbles yet further. And, as you can see above, there is no sign the trend has bottomed out. It’s possible it will break below the trough seen in the 1930s (the WWII and immediate post-war years were an anomaly due to gearing up, and then down, for the war effort).

The problem is that as velocity craters it sucks the air out of the real economy. Financial assets can flourish, as we’ve seen, at least for awhile. But the cure for high prices is, and always has been, high prices. Stocks, art, and real estate are not exempt from this reality. The huge problem—which investor and central banks are waking up to—is that when gravity bites, there is a spillover impact on economic activity.

Consequently, the monetary powers-that-be feel compelled to keep experimenting with ever more exotic elixirs, designed to perpetuate the artificial high. This channels even greater sums of money into overpriced assets (like buying bonds with negative yields) but does precious little for GDP. Simplistically, but, I think, accurately, trillions are diverted into financial engineering versus real engineering.

The next result in this daisy-chain of reactions is that the economy gets stuck in a state of suspended animation or what some experts have called “secular stagnation”. To combat this, governments are taking the fight to the next level by first declaring war on currency and then threatening to bring in the helicopters.

By the way, we’re not talking about a replay of that classic “Apocalypse Now” Ride of the Valkyries scene. However, it might be just as surreal if it happens.

If at first you don’t succeed…

The first ploy—the war on big bills—centers on trying to abolish “high value” notes like a “Bennie”, the US C-note. Based on how little one of those buys these days, it’s pretty laughable to consider it high-denomination, yet there is a move afoot to call them in, regardless. In Europe, a $500 euro note is in circulation and it is looking very endangered. The official rationale is that these must be eradicated to inhibit tax-dodging and the drug trade. (Are either of those a new phenomenon?) The more sinister—and likely—reason is that killing off big bills will make it harder for people to hoard cash rather than paying their bank to hold deposits. If there were to be a mass shift from deposits to cash, imagine what that would do to money velocity! (Hint, the direction would be decidedly southerly, not northerly.)*

As it becomes increasingly apparent that NIRP/ZIRP and QE are failing, policymakers are also floating the idea of helicopter money. This echoes the long-ago musings of the great Milton Friedman on how to combat depressions (last I looked we were far from that condition, however). Our most recent ex-Fed chairman Ben Bernanke also launched this notion about 15 years ago in a famous speech that earned him the nickname “Helicopter Ben”. The plan would be to once again issue bonds to fund the helicopter drop of cash directly to taxpayers (and many who don’t pay taxes!). This would almost certainly be heavily supported by the aforementioned print-and-buy central bank tactic, with most citizens receiving a check for, say, $2500. The theory is that this will be mostly and almost immediately spent.

It’s possible that such a tactic would work better than the others the central banks have pulled out of their silk top-hats in recent years. But it’s for sure not a surety. They may want to consider what happened in Japan a few years back when that nation issued its citizens spending coupons with an expiration date on them. Regardless of the spend-by-date, the typical recipient still hoarded them! (We’ve seen a whiff of that lately in the US where the windfall from the crash in gasoline prices was supposed to produce a consumer spending surge, but hasn’t.)

Moving beyond the potential ineffectiveness of a helicopter drop, let’s think about this entire monetary “Hail Mary” pass of printing money to buy government bonds. First, central banks today don’t actually print money such as Germany did during the infamous hyper-inflation of the 1920s Weimar Republic (which led to the rise of Adolf Hitler and the incomprehensible nightmare of WWII). Instead, they create reserves, basically digital money that is transferred to the big commercial banks, the dealers in government debt.These banks sell government bonds to the Fed or the ECB and receive the reserves in return (I know, pretty convoluted but we are talking a Federal agency here.)

In normal times—when there is demand for money for things like starting new businesses rather than just playing the financial markets—said reserves can be multiplied 8 to 10 times. This is why they are often referred to as high-powered money. In other words, these reserves are like one of my wife’s adult beverages—they carry a potent kick. But, as noted above, in today’s Twlight Zone economy, they mostly sit idle.

Consequently, there is a belief that this can go on forever. Moreover, some pundits are opining that this amounts to debt cancellation. For example, the Fed has “extinguished” 13% of our national debt, the ECB has theoretically wiped out 16% of its obligations, while the Bank of England has bought back 23% of all UK treasury debt outstanding. Debt-drenched Japan, naturally, is the leader of the pack with a 32% “retirement” of its government liabilities. Some believe all of government debt can be eliminated in this seemingly painless way.

As young folks are given to text these days, OMG! What brilliance! Why did it take them so long to figure this out? If you think there is a catch to this magical solution, you probably also are a believer that socialism works until you run out of other people’s money. In other words, you understand basic economics—unlike, it seems, most of those in the monetary control rooms these days.

The flaw in all of this gets back to the twin dilemma described above: We either see on-going economic flaccidness or those trillions of high-powered money start going viral, as does inflation. In other words, pick your poison.

Come on, Dave, how about accentuating the positive for a change?

Does Debbie Downer have a brother?

You may have noticed that this month’s full-length EVA is a follow-up to the March 25th issue, discussing “The Great Equalizer” of zero and negative interest rates. That edition generated a fair amount of positive response—despite the fact I wrote it. But, as is often the case, there was some “Davey-Downer” feedback.

While it’s certainly true that I think—and have believed for years—the world’s central banks are putting all of us at grave risk, it’s been pretty hard to miss the myriad bullish calls in this newsletter over the past year or so. Admittedly, these have been heavily focused on the smoking ruins of the formerly high-flying energy-related areas. But have you looked at those lately? The S&P 500 has certainly had a great run since early February but that pales by comparison to the rally seen in that timeframe by asset classes such as MLPs (the pipelines), Canadian REITs and gold/gold mining stocks (the latter have been long-time favorites, as well).

For sure, all of these have much further to go to recover from a catastrophic performance in 2015 (and since 2013 for gold). But realize that you can still get 7% to 8% returns on many MLPs and Canadian REITs. Additionally, most of them remain down 40% from their 2014 highs. (By the way, be prepared for a correction after such a dramatic up-move but we believe they have much further to rise over time.)

In other words, Evergreen is willing to be very bullish—and lonely—when valuations are highly attractive. Someday, that will include US stocks. But, for a moment, just slow down and reflect on this chart courtesy of our hard-working and talented Director of Portfolios, Jeff Dicks.

S&P PERFORMANCE AND US GDP GROWTH SINCE 1970

Source: Evergreen Gavekal, Bloomberg

Clearly, the S&P has consistently returned back to the long-term trend of GDP growth and has always gone below it during bear markets (and has often stayed there for years). Ergo, being bullish US stocks, other than on a trading basis, just doesn’t reconcile with the reality displayed above.

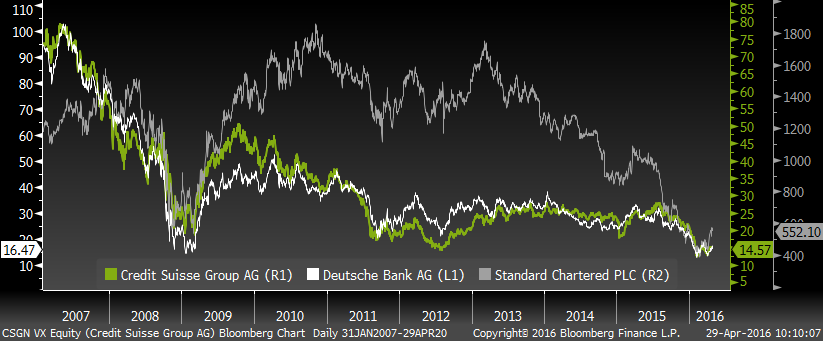

Further, if conditions around the world were truly healthy, why would negative interest rates be spreading like rumors about the cause of Prince’s untimely demise? And why have some of the most important banks in the world recently broken below their 2009 end-of-the-world lows?

THREE LEADING BANK STOCK PRICE CHARTS SINCE 2007

Source: Evergreen Gavekal, Bloomberg

If the world’s economies were really out of intensive care, why would ultra-radical monetary policies like helicopter money be increasingly debated at the highest level of governments? Also, how come 70% of Americans believe the US economy is on the wrong course? And why do almost half of US citizens admit they couldn’t come up with $400 to meet an unexpected need? Yes, I know why ask why? And it is what is, and a bunch of other clichés. But this isn’t normal, it isn’t healthy, and—at least in the opinion of this author—it isn’t going to end well.

Rising above human nature.

This week I’ve been viewing a TV series on AHC (American Heroes Channel) dedicated to the rise of Fascism during the 1930s. Frankly, it broke my heart. The loss of human life and the brutality of the demagogues of that decade were almost unbearable to watch.

Past EVAs and other sources, such as celebrated demographer Neil Howe, have pointed out the numerous parallels with present times and the decade of the Great Depression. Obviously, there are many, many differences but the growing similarities are becoming disquieting in the extreme. These include but are not limited to: rising nationalism, growing protectionism, currency wars, the ascendancy of far-right and hard-left political candidates, eroding faith in key institutions, an isolationist US, chronic over-capacity in numerous industries, and a host of other similarities.

But let’s end on a positive note, even of a qualified nature. Everyone with a healthy dose of rationality realized long ago that not all the debt countries like the US have accumulated can be serviced, much less repaid. This inability would be dramatically worsened in the event interest rates “normalize”. Therefore, some kind of restructuring—aka, default—was always in the cards, barring the type of sweeping entitlement reforms, like Simpson-Bowles, for which there appears to be almost zero political appetite.

For a country like America, with the good fortune to be able to repay its liabilities in its own currency, the de facto default scenario was likely to be using inflation to gradually erode the value of the indebtedness. In other words, there would be a kind of stealth shafting of creditors. Even the 2%-type inflation the US has experienced for years is a form of this, though it has been a very slow bleed.

Now, however, there is an alternative path. Instead of lowering the total debt outstanding through high inflation, we have witnessed a huge reduction in the interest rate on these liabilities. As long as rates stay near zero, there is no need to resort to inflation. But it does create a situation where governments have a perverse incentive to keep growth slow and interest rates suppressed. As years of deficient economic activity have demonstrated (case in point: today’s pathetic GDP report), present policies seem to be doing a superb job of exactly that!

Japan has shown that a rich country can limp along for decades and keep piling up the national debt as long as rates stay close to zero. (Now that they’ve gone below zero, the sky’s the limit!) Evergreen has asserted for many years that we need to be on alert for the Japanization of America in terms of what were once unthinkably low rates. As noted earlier in this letter, the European Union is well ahead of us in that regard.

On another semi-upbeat note, perhaps this tepid condition—with central banks constantly holding down interest rates and propping up asset prices—can keep the stock market in a long-term trading range versus a painful, but cathartic, bear market. By definition, though, it’s hard to make money in a sideways market, unless you are nimble enough to sell into rallies and buy into pull-backs.

The implication for investors from all of this is just how challenging it will be to produce adequate cash flow and/or returns. But as we saw last year for all things energy-related, there will be opportunities to do so when money is rapidly fleeing from certain market sectors and/or asset classes. A passive 60% stocks/40% bonds portfolio just isn’t going to cut it.

There’s rarely been a time when following a contrarian approach has been so essential. The trouble with being a contrarian is that it’s just so darn contrary to human nature. But as Katherine Hepburn told Humphrey Bogart in The African Queen, human nature is what we are put in this world to rise above.

*Trying to eliminate the $500 euro might be quite a battle in Deutschland. As my buddy, Grant Williams, points out, 84% of transactions in Germany in 2014 were in cash. There must be a lot of German drug dealers and tax-cheats!

The post “If…” appeared first on crude-oil.top.