There has been a recent spike in the number of Unchanged Issues which has, at times, signaled too much investor complacency in the past.

As readers are aware, our biggest stock market concern in recent weeks has been focused on the widespread overly bullish sentiment. Today’s Chart Of The Day presents one further example of potentially too much complacency on the part of investors – at least prior to today’s market plunge. Perhaps the most disregarded yet widely disseminated market statistic is the number of Unchanged Issues on the exchanges on a given day. Everyone focuses (rightly so) on Advancers and Decliners, but mostly ignores the Unchanged Issues. We mostly did as well, until we began to chart them more closely a few years ago.

Interestingly enough, we found that spikes in Unchanged Issues can be a sign of complacency while low levels can indicate elevated fear on the part of investors. These signals can be valuable on a contrarian basis when identifying potential bottoms and tops in the market. If you think about it, when market fear is high – at bottoms – volume is elevated and stocks of all stripes are on the minds of investors. When markets are rising – or stagnant – some issues, especially lightly traded ones, may slip investors’ consciousness.

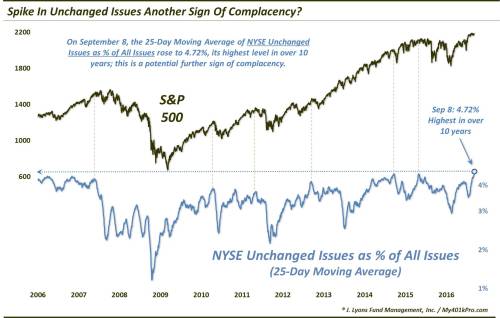

I know many folks may find this notion a bit of a reach, or just downright goofy, but take a peak at the chart below. When tracking Unchanged Issues on the NYSE (using a 25-day average), we have seen that spikes have tended to occur near intermediate-term market tops. It is not a foolproof signal, but elevated numbers of Unchanged Issues showed up near tops in June 2007, April 2010, April 2011, September 2012, September 2014 and May 2015.

The concern currently is that NYSE Unchanged Issues as a % of All Issues is at its highest level in more than 10 years.

So is this signal a valid red flag? And has today’s action taken away some of the sting? (By the way, we regret not being able to post this prior to the day’s action – sometimes our client and subscriber responsibilities preclude more timely posts, however). The signal does fit with most of the frothy sentiment readings currently (yesterday’s post highlights one exception). If indeed we are witnessing a peak in this Unchanged Issues indicator, today may be just the beginning of at least an intermediate-term (i.e., weeks-months) slide in the market. At least, that would be the suggestion based on prior spikes.

* * *

More from Dana Lyons, JLFMI and My401kPro.

The post Is This Widely Ignored Indicator Signaling Investor Complacency? appeared first on crude-oil.top.