Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Take a declining population with declining rates of productivity growth and load it up with debt, and you get a triple-whammy recipe for permanent stagnation.

One of our longtime friends in Japan just sold the family business. The writing was on the wall, and had been for the past decade: fewer customers, with less money, and no end of competition for the shrinking pool of customers and spending.

Our friend is planning to move to another more vibrant economy in Asia. She didn't want to spend the rest of her life struggling to keep the business afloat. She wanted to have a family and a business with a future. It was the right decision, not only for her but for her family: get out while there's still some value in the business to sell.

I have written a number of entries on Japan's economic downward-spiral and its largely hidden social depression over the past decade, most recently: Global Bellwether: Japan's Social Depression (September 25, 2014)

Lessons from Japan: Decades of Decay, Unavoidable Collapse (April 26, 2016)

The Keynesian Fantasy is that encouraging people to borrow money to replace what they no longer earn is a policy designed to fail, and fail it has. Borrowing money incurs interest payments, which even at low rates of interest eventually crimps disposable earnings.

Banks must loan this money at a profit, so interest rates paid by borrowers can't fall to zero. If they do, banks can't earn enough to pay their operating costs, and they will close their doors.

If banks reach for higher income, that requires loaning money to poor credit risks and placing risky bets in financial markets. Once you load them up with enough debt, even businesses and wage earners who were initially good credit risks become poor credit risks.

Uncreditworthy borrowers default, costing the banks not just whatever was earned on the risky loans but the banks' capital.

The banking system is designed to fail, and fail it does. Japan has played the pretend-and-extend game for decades by extending defaulting borrowers enough new debt to make minimal interest payments, so the non-performing loan can be listed in the "performing" category.

Central banks play the game by lowering interest rates so debtors can borrow more. This works like monetary cocaine for a while, boosting spending and giving the economy a false glow of health, but then the interest payments start sapping earnings, and once the borrowed money has been spent/squandered, what's left is the interest payments stretching into the future.

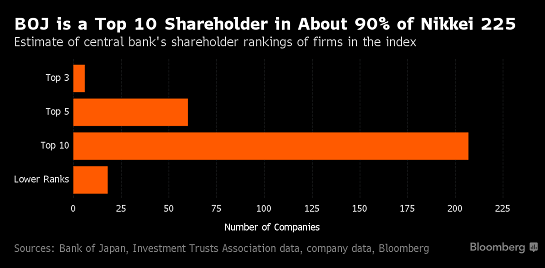

Central banks played another game: buying assets to inflate asset bubbles, bubbles that were supposed to spark the wealth effect: once businesses and households see their net worth rise as assets bubble higher, they will be psychologically induced to borrow against that new wealth and spend, spend, spend.

The Bank of Japan has played this game to little effect. The BOJ now owns a significant chunk of Japan's stock market, but the real economy continues its long descent into stagnation.

Demographics matter. As the populace ages, older people spend less and sell assets to raise cash for their non-earning retirement years. As young families have fewer children, consumption declines accordingly.

Take a declining population with declining rates of productivity growth and load it up with debt, and you get a triple-whammy recipe for permanent stagnation. There are Degrowth strategies that make sense because they're designed to be sustainable, but first the systems that have been designed to fail–Keynesian stimulus policies and the banking system–must be allowed to fail.

The post Japan: A Future Of Stagnation appeared first on crude-oil.top.