Submitted by Nicole Foss via The Autiomatic Earth blog,

Read Negative Rates & The War On Cash, Part 1: "There Is Nowhere To Go But Down" here

Read Negative Rates & The War On Cash, Part 2: "Closing The Escape Routes" here

Bitcoin and other electronic platforms have paved the way psychologically for a shift away from cash, although they have done so by emphasising decentralisation and anonymity rather than the much greater central control which would be inherent in a mainstream electronic currency. The loss of privacy would no doubt be glossed over in any media campaign, as would the risks of cyber-attack and the lack of a fallback for providing liquidity to the economy in the event of a systems crash. Electronic currency is much favoured by techno-optimists, but not so much by those concerned about the risks of absolute structural dependency on technological complexity. The argument regarding greatly reduced socioeconomic resilience is particularly noteworthy, given the vulnerability and potential fragility of electronic systems.

There is an important distinction to be made between official electronic currency – allowing everyone to hold an account with the central bank — and private electronic currency. It would be official currency which would provide the central control sought by governments and central banks, but if individuals saw central bank accounts as less risky than commercial institutions, which seems highly likely, the extent of the potential funds transfer could crash the existing banking system, causing a bank run in a similar manner as large-scale cash withdrawals would. As the power of money creation is of the highest significance, and that power is currently in private hands, any attempt to threaten that power would almost certainly be met with considerable resistance from powerful parties. Private digital currency would be more compatible with the existing framework, but would not confer all of the control that governments would prefer:

People would convert a very large share of their current bank deposits into official digital money, in effect taking them out of the private banking system. Why might this be a problem? If it’s an acute rush for safety in a crisis, the risk is that private banks may not have enough reserves to honour all the withdrawals. But that is exactly the same risk as with physical cash: it’s often forgotten that it’s central bank reserves, not the much larger quantity of deposits, that banks can convert into cash with the central bank. Both with cash and official e-cash, the way to meet a more severe bank run is for the bank to borrow more reserves from the central bank, posting its various assets as security. In effect, this would mean the central bank taking over the funding of the broader economy in a panic — but that’s just what central banks should do.

A more chronic challenge is that people may prefer the safety of central bank accounts even in normal times. That would destroy private banks’ current deposit-funded model. Is that a bad thing? They would still have a role as direct intermediators between savers and borrowers, by offering investment products sufficiently attractive for people to get out of the safety of e-cash. Meanwhile, the broad money supply would be more directly under the control of the central bank, whereas now it’s a product of the vagaries of private lending decisions. The more of the broad money supply that was in the form of official digital cash, the easier it would be, for example, for the central bank to use tools such as negative interest rates or helicopter drops.

As an indication that the interests of the private banking system and public central authorities are not always aligned, consider the actions of the Bavarian Banking Association in attempting to avoid the imposition of negative interest rates on reserves held with the ECB:

German newspaper Der Spiegel reported yesterday that the Bavarian Banking Association has recommended that its member banks start stockpiling PHYSICAL CASH. The Bavarian Banking Association has had enough of this financial dictatorship. Their new recommendation is for all member banks to ditch the ECB and instead start keeping their excess reserves in physical cash, stored in their own bank vaults. This is officially an all-out revolution of the financial system where banks are now actively rebelling against the central bank. (What’s even more amazing is that this concept of traditional banking — holding physical cash in a bank vault — is now considered revolutionary and radical.)

There’s just one teensy tiny problem: there simply is not enough physical cash in the entire financial system to support even a tiny fraction of the demand. Total bank deposits exceed trillions of euros. Physical cash constitutes just a small percentage of that sum. So if German banks do start hoarding physical currency, there won’t be any left in the financial system. This will force the ECB to choose between two options:

- Support this rebellion and authorize the issuance of more physical cash; or

- Impose capital controls.

Given that just two weeks ago the President of the ECB spoke about the possibility of banning some higher denomination cash notes, it’s not hard to figure out what’s going to happen next.

Advantages of official electronic currency to governments and central banks are clear. All transactions are transparent, and all can be subject to fees and taxes. Central control over the money supply would be greatly increased and tax evasion would be difficult to impossible, at least for ordinary people. Capital controls would be built right into the system, and personal spending information would be conveniently gathered for inspection by central authorities (for cross-correlation with other personal data they possess). The first step would likely be to set up a dual system, with both cash and electronic money in parallel use, but with electronic money as the defined unit of value and cash subject to a marginally disadvantageous exchange rate.

The exchange rate devaluing cash in relation to electronic money could increase over time, in order to incentivize people to switch away from seeing physical cash as a store of value, and to increase their preference for goods over cash. In addition to providing an active incentive, the use of cash would probably be publicly disparaged as well as actively discouraged in many ways. For instance, key functions such as tax payments could be designated as by electronic remittance only. The point would be to force everyone into the system by depriving them of the choice to opt out. Once all were captured, many forms of central control would be possible, including substantial account haircuts if central authorities deemed them necessary.

The main promoters of cash elimination in favour of electronic currency are Willem Buiter, Kenneth Rogoff, and Miles Kimball.

Economist Willem Buiter has been pushing for the relegation of cash, at least the removal of its status as official unit of account, since the financial crisis of 2008. He suggests a number of mechanisms for achieving the transition to electronic money, emphasising the need for the electronic currency to become the definitive unit of account in order to implement substantially negative interest rates:

The first method does away with currency completely. This has the additional benefit of inconveniencing the main users of currency-operators in the grey, black and outright criminal economies. Adequate substitutes for the legitimate uses of currency, on which positive or negative interest could be paid, are available. The second approach, proposed by Gesell, is to tax currency by making it subject to an expiration date. Currency would have to be “stamped” periodically by the Fed to keep it current. When done so, interest (positive or negative) is received or paid.

The third method ends the fixed exchange rate (set at one) between dollar deposits with the Fed (reserves) and dollar bills. There could be a currency reform first. All existing dollar bills and coin would be converted by a certain date and at a fixed exchange rate into a new currency called, say, the rallod. Reserves at the Fed would continue to be denominated in dollars. As long as the Federal Funds target rate is positive or zero, the Fed would maintain the fixed exchange rate between the dollar and the rallod.

When the Fed wants to set the Federal Funds target rate at minus five per cent, say, it would set the forward exchange rate between the dollar and the rallod, the number of dollars that have to be paid today to receive one rallod tomorrow, at five per cent below the spot exchange rate — the number of dollars paid today for one rallod delivered today. That way, the rate of return, expressed in a common unit, on dollar reserves is the same as on rallod currency.

For the dollar interest rate to remain the relevant one, the dollar has to remain the unit of account for setting prices and wages. This can be encouraged by the government continuing to denominate all of its contracts in dollars, including the invoicing and payment of taxes and benefits. Imposing the legal restriction that checkable deposits and other private means of payment cannot be denominated in rallod would help.

In justifying his proposals, he emphasises the importance of combatting criminal activity…

The only domestic beneficiaries from the existence of anonymity-providing currency are the criminal fraternity: those engaged in tax evasion and money laundering, and those wishing to store the proceeds from crime and the means to commit further crimes. Large denomination bank notes are an especially scandalous subsidy to criminal activity and to the grey and black economies.

… over the acknowledged risks of government intrusion in legitimately private affairs:

My good friend and colleague Charles Goodhart responded to an earlier proposal of mine that currency (negotiable bearer bonds with legal tender status) be abolished that this proposal was “appallingly illiberal”. I concur with him that anonymity/invisibility of the citizen vis-a-vis the state is often desirable, given the irrepressible tendency of the state to infringe on our fundamental rights and liberties and given the state’s ever-expanding capacity to do so (I am waiting for the US or UK government to contract Google to link all personal health information to all tax information, information on cross-border travel, social security information, census information, police records, credit records, and information on personal phone calls, internet use and internet shopping habits).

In his seminal 2014 paper “Costs and Benefits to Phasing Out Paper Currency.”, Kenneth Rogoff also argues strongly for the primacy of electronic currency and the elimination of physical cash as an escape route:

Paper currency has two very distinct properties that should draw our attention. First, it is precisely the existence of paper currency that makes it difficult for central banks to take policy interest rates much below zero, a limitation that seems to have become increasingly relevant during this century. As Blanchard et al. (2010) point out, today’s environment of low and stable inflation rates has drastically pushed down the general level of interest rates. The low overall level, combined with the zero bound, means that central banks cannot cut interest rates nearly as much as they might like in response to large deflationary shocks.

If all central bank liabilities were electronic, paying a negative interest on reserves (basically charging a fee) would be trivial. But as long as central banks stand ready to convert electronic deposits to zero-interest paper currency in unlimited amounts, it suddenly becomes very hard to push interest rates below levels of, say, -0.25 to -0.50 percent, certainly not on a sustained basis. Hoarding cash may be inconvenient and risky, but if rates become too negative, it becomes worth it.

However, he too notes associated risks:

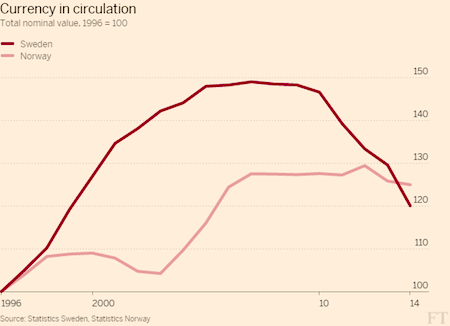

Another argument for maintaining paper currency is that it pays to have a diversity of technologies and not to become overly dependent on an electronic grid that may one day turn out to be very vulnerable. Paper currency diversifies the transactions system and hardens it against cyber attack, EMP blasts, etc. This argument, however, seems increasingly less relevant because economies are so totally exposed to these problems anyway. With paper currency being so marginalized already in the legal economy in many countries, it is hard to see how it could be brought back quickly, particularly if ATM machines were compromised at the same time as other electronic systems.

A different type of argument against eliminating currency relates to civil liberties. In a world where society’s mores and customs evolve, it is important to tolerate experimentation at the fringes. This is potentially a very important argument, though the problem might be mitigated if controls are placed on the government’s use of information (as is done say with tax information), and the problem might also be ameliorated if small bills continue to circulate. Last but not least, if any country attempts to unilaterally reduce the use of its currency, there is a risk that another country’s currency would be used within domestic borders.

Miles Kimball’s proposals are very much in tune with Buiter and Rogoff:

There are two key parts to Miles Kimball’s solution. The first part is to make electronic money or deposits the sole unit of account. Everything else would be priced in terms of electronic dollars, including paper dollars. The second part is that the fixed exchange rate that now exists between deposits and paper dollars would become variable. This crawling peg between deposits and paper currency would be based on the state of the economy. When the economy was in a slump and the central bank needed to set negative interest rates to restore full employment, the peg would adjust so that paper currency would lose value relative to electronic money. This would prevent folks from rushing to paper currency as interest rates turned negative. Once the economy started improving, the crawling peg would start adjusting toward parity.

This approach views the economy in very mechanistic terms, as if it were a machine where pulling a lever would have a predictable linear effect — make holding savings less attractive and automatically consumption will increase. This is actually a highly simplistic view, resting on the notions of stabilising negative feedback and bringing an economy ‘back into equilibrium’. If it were so simple to control an economy centrally, there would never have been deflationary spirals or economic depressions in the past.

Assuming away the more complex aspects of human behaviour — a flight to safety, the compulsion to save for a rainy day when conditions are unstable, or the natural response to a negative ‘wealth effect’ — leads to a model divorced from reality. Taxing savings does not necessarily lead to increased consumption, in fact it is far more likely to have the opposite effect.:

But under Miles Kimball’s proposal, the Fed would lower interest rates to below zero by taxing away balances of e-currency. This is a reduction in monetary base, just like the case of IOR, and by itself would be contractionary, not expansionary. The expansionary effects of Kimball’s policy depend on the assumption that households will increase consumption in response to the taxing of their cash savings, rather than letting their savings depreciate.

That needn’t be the case — it depends on the relative magnitudes of income and substitution effects for real money balances. The substitution effect is what Kimball has in mind — raising the price of real money balances will induce substitution out of money and into consumption. But there’s also an income effect, whereby the loss of wealth induces less consumption and more savings. Thus, negative interest rate policy can be contractionary even though positive interest rate policy is expansionary.

Indeed, what Kimball has proposed amounts to a reverse Bernanke Helicopter — imagine a giant vacuum flying around the country sucking money out of people’s pockets. Why would we assume that this would be inflationary?

Given that the effect on the money supply would be contractionary, the supposed stimulus effect on the velocity of money (as, in theory, savings turn into consumption in order to avoid the negative interest rate penalty) would have to be large enough to outweigh a contracting money supply. In some ways, modern proponents of electronic money bearing negative interest rates are attempting to copy Silvio Gesell’s early 20th century work. Gesell proposed the use of stamp scrip — money that had to be regularly stamped, at a small cost, in order to remain current. The effect would be for money to lose value over time, so that hoarding currency it would make little sense. Consumption would, in theory, be favoured, so money would be kept in circulation.

This idea was implemented to great effect in the Austrian town of Wörgl during the Great Depression, where the velocity of money increased sufficiently to allow a hive of economic activity to develop (temporarily) in the previously depressed town. Despite the similarities between current proposals and Gesell’s model applied in Wörgl, there are fundamental differences:

There is a critical difference, however, between the Wörgl currency and the modern-day central bankers’ negative interest scheme. The Wörgl government first issued its new “free money,” getting it into the local economy and increasing purchasing power, before taxing a portion of it back. And the proceeds of the stamp tax went to the city, to be used for the benefit of the taxpayers….Today’s central bankers are proposing to tax existing money, diminishing spending power without first building it up. And the interest will go to private bankers, not to the local government.

The Wörgl experiment was a profoundly local initiative, instigated at the local government level by the mayor. In contrast, modern proposals for negative interest rates would operate at a much larger scale and would be imposed on the population in accordance with the interests of those at the top of the financial foodchain. Instead of being introduced for the direct benefit of those who pay, as stamp scrip was in Wörgl, it would tax the people in the economic periphery for the continued benefit of the financial centre. As such it would amount to just another attempt to perpetuate the current system, and to do so at a scale far beyond the trust horizon.

As the trust horizon contracts in times of economic crisis, effective organizational scale will also contract, leaving large organizations (both public and private) as stranded assets from a trust perspective, and therefore lacking in political legitimacy. Large scale, top down solutions will be very difficult to implement. It is not unusual for the actions of central authorities to have the opposite of the desired effect under such circumstances:

Consumers today already have very little discretionary money. Imposing negative interest without first adding new money into the economy means they will have even less money to spend. This would be more likely to prompt them to save their scarce funds than to go on a shopping spree. People are not keeping their money in the bank today for the interest (which is already nearly non-existent). It is for the convenience of writing checks, issuing bank cards, and storing their money in a “safe” place. They would no doubt be willing to pay a modest negative interest for that convenience; but if the fee got too high, they might pull their money out and save it elsewhere. The fee itself, however, would not drive them to buy things they did not otherwise need.

People would be very likely to respond to negative interest rates by self-organising alternative means of exchange, rather than bowing to the imposition of negative rates. Bitcoin and other crypto-currencies would be one possibility, as would using foreign currency, using trading goods as units of value, or developing local alternative currencies along the lines of the Wörgl model:

The use of sheep, bottled water, and cigarettes as media of exchange in Iraqi rural villages after the US invasion and collapse of the dinar is one recent example. Another example was Argentina after the collapse of the peso, when grain contracts priced in dollars were regularly exchanged for big-ticket items like automobiles, trucks, and farm equipment. In fact, Argentine farmers began hoarding grain in silos to substitute for holding cash balances in the form of depreciating pesos.

For the electronic money model grounded in negative interest rates to work, all these alternatives would have to be made illegal, or at least hampered to the point of uselessness, so people would have no other legal choice but to participate in the electronic system. Rogoff seems very keen to see this happen:

Won’t the private sector continually find new ways to make anonymous transfers that sidestep government restrictions? Certainly. But as long as the government keeps playing Whac-A-Mole and prevents these alternative vehicles from being easily used at retail stores or banks, they won’t be able fill the role that cash plays today. Forcing criminals and tax evaders to turn to riskier and more costly alternatives to cash will make their lives harder and their enterprises less profitable.

It is very likely that in times of crisis, people would do what they have to do regardless of legal niceties. While it may be possible to close off some alternative options with legal sanctions, it is unlikely that all could be prevented, or even enough to avoid the electronic system being fatally undermined.

The other major obstacle would be overcoming the preference for cash over goods in times of crisis:

Understanding how negative rates may or may not help economic growth is much more complex than most central bankers and investors probably appreciate. Ultimately the confusion resides around differences in view on the theory of money. In a classical world, money supply multiplied by a constant velocity of circulation equates to nominal growth.

In a Keynesian world, velocity is not necessarily constant — specifically for Keynes, there is a money demand function (liquidity preference) and therefore a theory of interest that allows for a liquidity trap whereby increasing money supply does not lead to higher nominal growth as the increase in money is hoarded. The interest rate (or inverse of the price of bonds) becomes sticky because at low rates, for infinitesimal expectations of any further rise in bond prices and a further fall in interest rates, demand for money tends to infinity.

In Gesell’s world money supply itself becomes inversely correlated with velocity of circulation due to money characteristics being superior to goods (or commodities). There are costs to storage that money does not have and so interest on money capital sets a bar to interest on real capital that produces goods. This is similar to Keynes’ concept of the marginal efficiency of capital schedule being separate from the interest rate. For Gesell the product of money and velocity is effective demand (nominal growth) but because of money capital’s superiority to real capital, if money supply expands it comes at the expense of velocity.

The new money supply is hoarded because as interest rates fall, expected returns on capital also fall through oversupply — for economic agents goods remain unattractive to money. The demand for money thus rises as velocity slows. This is simply a deflation spiral, consumers delaying purchases of goods, hoarding money, expecting further falls in goods prices before they are willing to part with their money….In a Keynesian world of deficient demand, the burden is on fiscal policy to restore demand. Monetary policy simply won’t work if there is a liquidity trap and demand for cash is infinite.

During the era of globalisation (since the financial liberalisation of the early 1980s), extractive capitalism in debt-driven over-drive has created perverse incentives to continually increase supply. Financial bubbles, grounded in the rediscovery of excess leverage, always act to create an artificial demand stimulus, which is met by artificially inflated supply during the boom phase. The value of the debt created collapses as boom turns into bust, crashing the money supply, and with it asset price support. Not only does the artificial stimulus disappear, but a demand undershoot develops, leaving all that supply without a market. Over the full cycle of a bubble and its aftermath, credit is demand neutral, but within the bubble it is anything but neutral. Forward shifting the demand curve provides for an orgy of present consumption and asset price increases, which is inevitably followed by the opposite.

Kimball stresses bringing demand forward as a positive aspect of his model:

In an economic situation like the one we are now in, we would like to encourage a company thinking about building a factory in a couple of years to build that factory now instead. If someone would lend to them at an interest rate of -3.33% per year, the company could borrow $1 million to build the factory now, and pay back something like $900,000 on the loan three years later. (Despite the negative interest rate, compounding makes the amount to be paid back a bit bigger, but not by much.)

That would be a good enough deal that the company might move up its schedule for building the factory. But everything runs aground on the fact that any potential lender, just by putting $1 million worth of green pieces of paper in a vault could get back $1 million three years later, which is a lot better than getting back a little over $900,000 three years later.

This is, however, a short-sighted assessment. Stimulating demand today means a demand undershoot tomorrow. Kimball names long term price stability as a primary goal, but this seems unlikely. Large scale central planning has a poor track record for success, to put it mildly. It requires the central authority in question to have access to all necessary information in realtime, and to have the ability to respond to that information both wisely and rapidly, or even proactively. It also assumes the ability to accurately filter out misinformation and disinformation. This is unlikely even in good times, thanks to the difficulties of ‘organizational stupidity’ at large scale, and even more improbable in the times of crisis.

The post Negative Interest Rates & The War On Cash, Part 3: “Beware The Promoters” appeared first on crude-oil.top.