In a world where fair value is a central bank veiled enigma it’s frankly a challenge to keep things real, but I’ll have a go at it in what will be a 3 part series covering central banks, the underlying fundamental picture, and a technical assessment of charts. In this part I’ll be covering central banks and putting their actions into context of the realities of a changing world and will aim to address some of the implications.

Part I: Central banks

After years of watching central bankers do their bidding I’ve come to the conclusion that they are the designers of the ultimate Pokemon Go game by leading investors to ever more extreme locations to find little yield nuggets on their screens.

My largest criticism of this game has been that free market price discovery is largely dead and nobody knows what is real any longer, producing a false sense of security as, at any signs of trouble, central banks feel compelled to intervene ever further removing markets from their natural balance. In short: Creating a bubble with devastating consequences we will all end up paying for in one form or another.

For now one may call it a market of pure multiple expansion as GAAP earnings and price have completely diverged in 2016:

Indeed, as earnings have declined since their peak in 2015 we have seen one central bank intervention after another. Just in 2016 alone we have witnessed dozens of new rate cuts, the ECB modified and added to its QE program with QE3 an almost forgone conclusion, Japan added stimulus with the BOJ on track to own 60% of all ETFs in Japan with more to come. China intervened repeatedly, the UK cut rates and re-launched QE as well, and central banks such as the SNB have been busy expanding their share purchases of US stocks.

And while, after much handwringing, the FOMC finally managed to hike rates once in December of 2015 (and setting the expectation for 4 rate hikes in 2016) it immediately reversed course during the February correction and stopped any notion of rate hikes for 2016.

In short: 2016 has been an absolute bonanza for central bank action.

The impact of all these actions: The continued crushing of yields further exacerbating artificial capital flows in a desperate search for yield in other places, i.e. higher yielding assets such as US dividend paying stocks.

As a result of all this action over the years we have become accustomed to the notion that bad news is good news. Investors have come to rely on central banks simply intervening on any notion of trouble, in the dark mostly, sometimes more overtly via QE programs, but the secret sauce is always “liquidity”.

Mario Draghi made a stunning admission as to the whole truth in this regard recently. When asked about the market’s reaction to Brexit he finally explained what “resilient” means:

“What is clear is that financial markets, and also the banking sector, in spite of the large changes in the stock prices, have reacted in a fairly resilient fashion to the event. We haven’t observed any disruption, neither in the financial markets sector nor in the banking sector, and this was certainly caused by the large liquidity being abundant; by also all the preparations that all central banks had undertaken before, ensuring that liquidity lines would be available; and certainly by the accommodative monetary policies undertaken by all central banks at the present time.”

He couldn’t have stated it any clearer: “All the preparations” that “ALL Central banks had undertaken” (his words) and hence prevented natural price discovery to take hold for more than 48 hours and a negative became a positive. Magic.

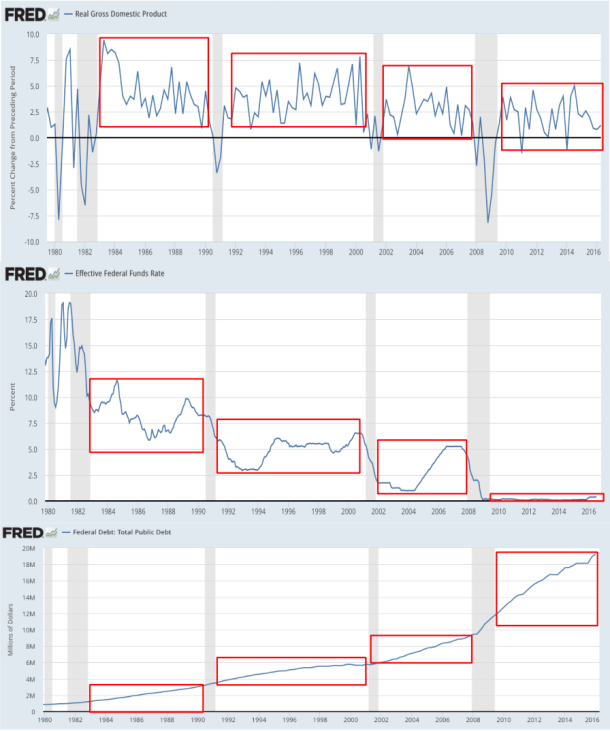

What’s driving all these ongoing and unprecedented policy actions? A simple structural reality: Growth has been slowing for decades. Intermittent recessions were handled with easy money (i.e. the cutting of rates to jumpstart the economy) and increases in government debt. They call it “stimulus”. What it really is is debt.

The observable results: Lower highs in GDP growth and lower highs in the Fed funds rate with ever more debt needed and ever more central bank intervention required to keep the construct alive:

The obvious problem for the Fed: They haven’t been able to raise rates again this time around and seem stuck. Janet Yellen’s reversal from her 4 rate hike projection for 2016 amounted to an effective cutting of rates again as the expectation was removed.

And, as a result, we saw yet again an inflation of asset prices. But it was accompanied by a massive drop in yields (and hence yield chasing) and not earnings expansion.

But this has been the gig for decades. As soon as markets correct rates need to drop in order to get markets to rise again:

Really think they will ever normalize this?

Let’s get real: We will never, ever, see normalized rates again in our lifetimes unless they are forced higher through a market event. The ship has sailed and central banks are clearly hinting at this, if not outright admitting it. Central banks are not leaders or guiding ships of our evolving reality, they react to these changes and their policies are a reflection of these changes. And the reality is finally dawning on all of them.

For years now I have argued that the Fed’s dot plot has been a complete fantasy and mathematically not feasible:

Then James Bullard of the St Louis Fed came out a few weeks ago with his “new narrative” He reiterated as much in recent interviews and his main point basically was: “Why bother raising rates when you have to just cut them again”?

And why would they have to cut again? Simple. Because the next recession is a matter of when and not if.

And Janet Yellen’s speech in August contained not to be missed nuggets outlining this issue:

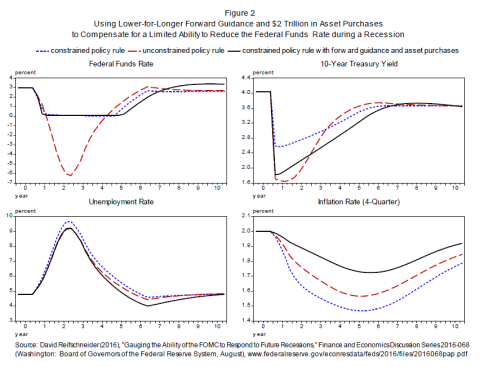

“Finally, the simulation analysis certainly overstates the FOMC’s current ability to respond to a recession, given that there is little scope to cut the federal funds rate at the moment. But that does not mean that the Federal Reserve would be unable to provide appreciable accommodation should the ongoing expansion falter in the near term. In addition to taking the federal funds rate back down to nearly zero, the FOMC could resume asset purchases and announce its intention to keep the federal funds rate at this level until conditions had improved markedly–although with long-term interest rates already quite low, the net stimulus that would result might be somewhat reduced.”

“On the monetary policy side, future policymakers might choose to consider some additional tools that have been employed by other central banks, though adding them to our toolkit would require a very careful weighing of costs and benefits and, in some cases, could require legislation. For example, future policymakers may wish to explore the possibility of purchasing a broader range of assets.”

Bill Gross’s (billionaire & head of Janus Capital Group Inc.) reaction was spot on:

“She is opening the door to creating even greater asset bubbles as have the BOJ and ECB and SNB by purchasing corporate bonds and stocks,” Gross wrote Friday in an e-mail response to questions. “This is not capitalism. This is providing a walker or a wheelchair for an ailing economy. It may never walk normally again if monetary policy continues in this direction.”

And yes it will continue and yes it is not capitalism. It is the end of the financial market models of the last century. It is a brave new world, don’t you know?

“Policymakers think new tools might be needed in an era of slower economic growth and a potentially giant and long-lasting trove of assets held by the Fed. And they are convinced the time to vet them is now, while rates look to be heading up.

“Central banking is in a brave new world,” Atlanta Fed President Dennis Lockhart said in an interview on the sidelines of the conference.

At the center of the Fed’s discussions is its $4.5 trillion balance sheet, built up by bond-buying sprees to combat the 2007-09 recession but which has been criticized by many lawmakers.

While policymakers have maintained the Fed should eventually reduce its bond holdings, Lockhart said some officials were closer to accepting that they needed to learn to live with them.“

They will never reduce their balance sheet. They will add to it. That’s the message.

Yellen’s comments were in context of a coming recession. We know a new recession will come. It’s just a matter of when and with a world drowning in debt the question is how central banks will respond to it and how markets can weather the storm.

Janet Yellen has already given her part of the answer: More asset purchases ($2 Trillion):

What these assets specifically would be she left unclear, note however she did not call them “risk” assets. Has risk ever stopped any central bank from buying anything? She also referred to “future policymakers”. I don’t know if she is implying an upcoming retirement on her part, or if she is so bold to declare no such asset purchases will occur on her watch.

So perhaps they will wring themselves to implement one rate hike in 2016, but don’t count on it or don’t count on any more after that. One hint of a recession and it’s all out the window and they will go back to zero with QE coming back.

Reality check: Central bank policies have not been sufficient to stoke growth, so in their eyes governments need to step in and help the process by stimulating more, i.e take on more debt.

And it’s a global issue. Example Japan:

The ECB’s solution to help stoke inflation? Take on more debt:

“They (stimulus measures) were taken on the implicit assumption that they would be transient,” Coeure told the U.S. Federal Reserve’s symposium in Jackson Hole.

“But if other economic policies do not in fact play this role, then we cannot exclude that the real equilibrium rate remains low.

“As such, we may see short-term rates being pushed to the effective lower bound more frequently in the event of macroeconomic shocks; and the stimulus provided by lowering interest rates to that level would be of course be much weaker.”

Translation: If governments don’t provide more stimulus we will have low rates forever:

And this is not a theoretical debate, it’s a real and live debate. See Japan:

“Japan should spend 10 trillion yen ($99.83 billion) on fiscal stimulus both in fiscal 2017 and in fiscal 2018 to offset a lack of demand in the economy and eliminate the risk of deflation, an adviser to Prime Minister Shinzo Abe said on Tuesday.

“We need to spend 10 trillion yen next fiscal year and another 10 trillion yen the following fiscal year to eliminate the deflationary gap.”

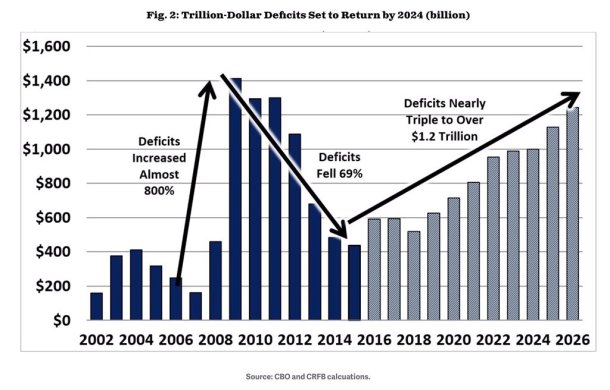

All this means that debt levels, as large as they are now, will continue to have to increase and perhaps exponentially so. The world will need ever more debt to sustain itself.

This is not an assertion it’s a fact and this reality is already reflected in the latest CBO projections:

This is without a recession built in. These are the obligations as they stand.

To summarize: Debt will continue to increase, rates will not rise over time, and asset purchases by central banks will not only continue, but further expand into corporate bonds and stocks at the first sign of a recession or even before.

This is the future programmed for the rest of our lifetimes as the reality is gnawing: The world is effectively bankrupt without these policies in place to sustain the system.

Why? Because none of the math works. Aside from overspending by governments the key drivers are demographics, and the impact of technology itself.

Consider some of the demographical math issues:

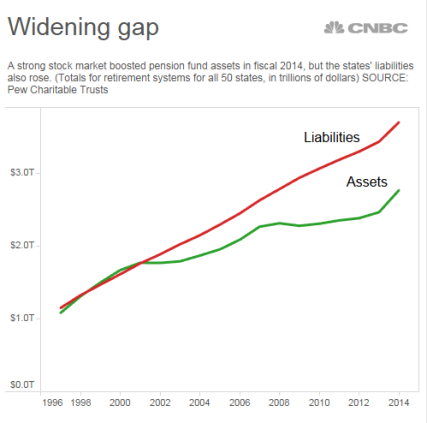

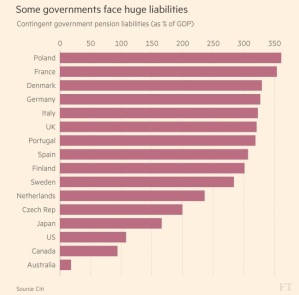

All entitlement programs including pension funds need growth to sustain themselves in the face of the changing demographic picture. The pension shortfalls are real and they are enormous:

Example: State pensions

“States face pension fund gap approaching $1 trillion. “The lesson here is that state and local policymakers cannot count solely on investment returns to close the pension funding gap over the long term,” the report said. While many states have cut benefits for new workers and frozen plans for current staff, they cannot cut benefits that have already been earned by public employees. That means they have to find money to make up the shortfall by cutting other programs, raising taxes or both.”

Swell. And the gaps will be widening with rates remaining low, or imagine, a larger stock market correction. The social contracts will be altered and the younger generation is already facing lesser benefits.

And this problem is global. Big time:

The driver: A shrinking working population with an expanding population of retirees.

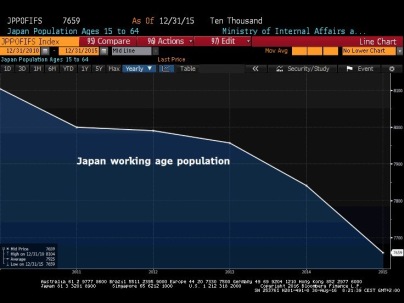

Example Japan:

Example China:

“But from the workforce peak of 928 million last year, China is set to see its working-age population shrink by 90 million in the coming two decades, and 190 million by 2050. As more of the population slip out of the workforce into retirement, two economically awkward things happen: consumer demand for “stuff” declines, and output growth that would drive broader economic growth is going to be steadily harder to achieve.”

These are big macro trends that are ongoing and a direct challenge to productivity growth.

So what choice do pension funds have but to expand into riskier assets to generate returns? Growth or bust. The Fed is very much aware of this:

Fed’s Evans, citing slow growth, says low U.S. rates are here to stay

“Chicago Federal Reserve Bank President Charles Evans on Wednesday said he is increasingly convinced that U.S. economic growth has slowed permanently, a situation that will keep U.S. interest rates low for a long time ahead.

Embracing Harvard Professor Larry Summers’ so-called secular stagnation theory, Evans argued that an aging U.S. population and slowing productivity growth mean there is little reason for interest rates to rise either fast or far.“

Demographic changes are real and they are a global problem and these pension funds need to show growth no matter what hence you get news flashes like this:

“The world’s biggest pension fund has room for a Japan stock shopping spree after the value of its investments tumbled last quarter.”

If you are wondering how this works:

“The $1.3 trillion Government Pension Investment Fund would need to spend $52 billion on domestic shares to meet its target for the asset, according to Bloomberg News calculations, after the fund said Friday that holdings fell to 21 percent of investments at the end of June. Its goal is a quarter of the portfolio. The fund also has scope to offload $55 billion in domestic bonds after falling yields boosted their weight to 39 percent of the total, above the 35 percent level it seeks to hold….The expected buying left from GPIF combined with BOJ annual buying add up to north of 10 trillion yen,” analysts led by Yohei Iwao, executive director of the institutional equities division, wrote in a report on Friday. “This should at least provide some support for equity markets,” but any purchases from the fund probably won’t happen until later this year.”

Translation: We HAVE to buy stocks no matter the valuation or expected return on investment. Besides, the BOJ is buying stocks too and they don’t care about valuation either. Brave new world indeed. Everyone buying stocks because they have to.

And considering that there are fewer and fewer stocks to choose from (the stock market is vanishing) everybody is piling into the same assets.

No bubbles here.

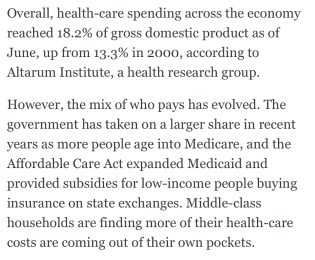

The other big demographic impact: The cost of health care continues to skyrocket and is taking on an ever larger share of GDP:

The main message: The math doesn’t work. At all. But it must be sustained and the only way they can do it is with rising stock markets.

Which brings me to the next point: Technology. In my mind technology is the greatest deflationary force on the planet. Yes some companies are succeeding greatly in killing off all competition and becoming de facto monopolies. Amazon, for example, succeeded by undercutting all of retail competition in price. Big box retail is under huge pressure because of it and they need to adapt quickly or die which many of them are.

The world is changing rapidly because of technology and whether it is all for the better is best left for a different debate. But these changes are all around us and they are coming much faster than anticipated.

Take driverless cars. In Singapore we already see a test of driverless taxis. Google is testing its driverless cars in multiple cities in the US already. And of course many companies including Tesla, Uber, Mercedes, etc. are heavily involved in advancing this next innovation. It’s coming and it’s coming fast and the implications for jobs are enormous. Taxi and bus drivers, truckers, even delivery personnel may find their jobs under threat sooner than they think.

But it’s not only driverless cars, it’s electric as well:

“Competition among electric vehicles and plug-in hybrids will be intense, which will drive down prices. Volkswagen AG has pledged to make every model available as a plug-in hybrid by 2025. BMW AG has made the same promise. Hyundai Motor Co. promises eight plug-in hybrid models by 2020, plus two all-electric vehicles. Toyota Motor Corp.’s overhaul of the plug-in Prius, boasting twice the range, arrives before the year is out.

Another trend will help—the proliferation of charging stations. ChargePoint Sunday said it has 30,000 stations in its network, where it collects any fees levied by owners. By comparison, there are about 90,000 publicly accessible gas stations in America, says Mike Fox, executive director of Gasoline & Automotive Services Dealers of America.

It is the nature of disruptive technological shifts that it seems like nothing is changing—until it seems as if everything is changing at once.

If Tesla can deliver on its current promises with the Model 3, says Mr. Fox, “gas vehicles are history—it’s horse and buggy days.”

What this tells me is this: No way, no how, will the Saudis be cutting production. They will aim to sell all the oil they can now and jawbone price as best as they can in the mean time. Any production cuts and higher oil prices will only further incentivize the technological forces that threaten their core product. The high oil price game is up. Oil consumption as we know is on its way out. Yes it won’t happen overnight, but they all know it’s coming, hence Saudi Arabia is producing oil at record levels. So while we may see the occasional flare up for this reason or another, the longer term trend is extremely clear: Oil is out, electric is in and quickly so. So my sense: If you are buying a gasoline based engine car today you are basically buying a dinosaur for a pet right before the asteroid hits.

And given rapid advances in AI and robotics what’s the point of jobs at taxi/trucking companies, at gas stations, at hotel counters, at airport check-ins? Customer service jobs? What for? Many of these jobs can be performed via AI eventually.

Heck we don’t even need headline writers anymore:

“On Friday, Facebook announced another small but notable change to Trending Topics: Human editors will no longer write the short story descriptions that accompany a trending topic on the site. Instead, Facebook is going to use algorithms to “pull excerpts directly from stories.”

I’m using this story as an example, but the threats of displacement as a result of advances in AI/robotics/technology are real and relevant now and in the years to come and they highlight what I’ve said earlier: Central banks are not driving these changes, they are reacting to them, knowingly or not. Technology, while creating new knowledge jobs, is threatening not only millions of old jobs, but the ubiquity of its reach is creating efficiencies to such an extent that it is indeed acting as the greatest deflationary force the world has ever seen.

In combination with a radically changing demographic picture the conclusion is clear:

The world has changed and is changing at a much more rapid pace than most of us realize and it’s impacting everything around us: Monetary policies, interest rates, debt levels, jobs, pensions, the information we get to see and absorb, how and what we trade, everything. The rules and models of the past are changing and what we knew to be true 10 years ago no longer applies.

We need to accept this and adapt. In other words: Get real.

For now cash has been parked in dividend yielding stocks, hence we have seen a flight to US large cap dividend yielding stocks. But even here we see evidence that the math doesn’t work as the trend of spending more than 100% of corporate profits on dividends is not sustainable. More here: Why the Math Doesn’t Work for Today’s Market.

So once this well dries up ( i.e. during the next recession) then what? I’m asking for a friend.

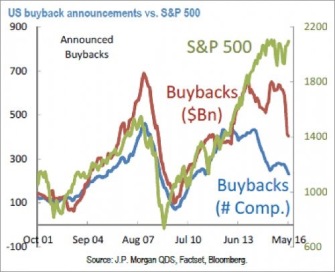

Look, we already see evidence that one equation of corporate splurging, buybacks, is being reduced:

What will replace it? Central bank buying? Most likely as central banks are already buying shares directly or indirectly.

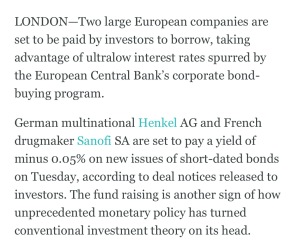

Given negative rates becoming more prevalent what’s to stop companies from getting paid by central banks to take on debt? In fact it’s already beginning:

Is it a reach then to think that companies will issue debt to buy back their own shares? Of course not, this has happened for years, the new aspect would be for them to get paid by central banks while doing it.

And why not aggressively buy stocks directly? Plenty of central banks are already doing it. The ECB may be next as it is running out of bonds to buy.

Perhaps future shareholder meetings will have all the same attendees:

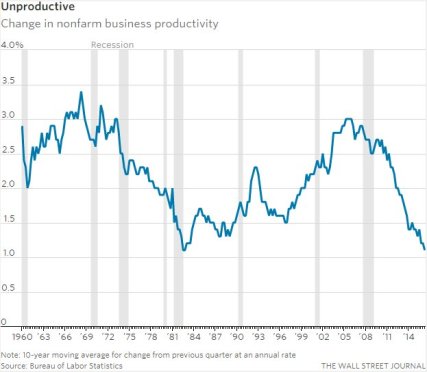

Does any of this produce growth? Of course not. Every central banker has been wrong about growth and none have a solution to the biggest obstacle to growth: Productivity. This is your trend:

So you see, central banks are doing what they are doing because they have to, the alternative is for markets to find a natural balance which would wreck havoc on the growth mandate the world needs to sustain the math construct. In short: The bull case for stocks remains 100% dependent on central bank action forcing artificial capital allocations. What does a stock market without central bank intervention look like? Nobody knows anymore.

And hence the notion of the next recession frankly worries me. My sense is the world is completely unprepared for it. Central banks will have no choice but to keep rates low to negative and buy more stocks and corporate and government bonds. The end result: Central banks will be owners of everything in one form or another. Government debt, corporate debt, and in many cases will be the largest shareholders of some of the largest companies on the planet. It’s a bizarre reality to contemplate, but as we have already seen in the case of Japan, it’s already happening. And the SNB is already all over $FB and $AAPL and the likes.

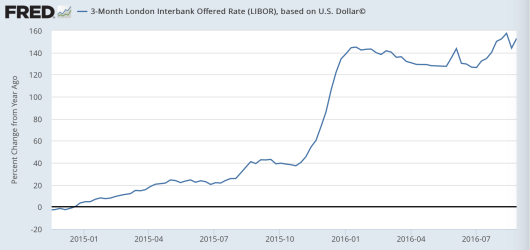

So in the face of slowing growth, unworkable math and vast and continued global central bank intervention what’s the end game here? As long as central banks can maintain control over the construct they have created one may be tempted to argue it can go on forever. I’m not sure if this is the future we want, but the alternative of course is concerning: Natural price discovery taking place and central banks losing control.

Are there signs that central banks could be losing control? You tell me:

The Fed is clearly thinking about the next recession. Markets have not. Yet. But in case people have forgotten the corporate mantra during recessions: Whoever can be replaced will be, and for those remaining: Do more with less. During the next downturn the new mantra may be: Talk to your assigned AI assistant about your exit package. The top end model with the empathy chip will cost extra.

The post Time To Get Real, Part 1: Central Banks appeared first on crude-oil.top.