The Federal Reserve blackout period is now upon us, giving traders a week to speculate on the impact of what has been said and the few pieces of data we get between now and the decision next Wednesday.

While a hawkish consensus does appear to be building among the committee, the absence of some key policy makers from this makes a hike at the meeting next week very unlikely. Lael Brainard added her name to the latter on Monday, dealing a major blow to hike chances this month and driving down the implied probability of one in the markets to only 15%. Brainard was in agreement with another Governor, Daniel Tarullo, that more evidence that inflation is returning sustainably towards target needs to be seen before raising interest rates. While the absence of these votes doesn’t prevent a hike from happening next week, it does make it very unlikely, which will now turn the focus to December.

EUR/USD – Euro Edges Lower on Weak German Economic Sentiment

US 10-year Treasury yields have edged a little lower again today following the comments from Brainard but remain above the levels seen for much of the last few months, perhaps reflecting the fact that expectations for December are still higher despite September appearing to be off the table. The US dollar is trading a little higher again today having come off a little yesterday on Brainard’s comments, which again suggests that traders are only writing off September and a hike this year remains very much on the cards, which is bullish for the greenback.

Comments from Fed officials in recent days is likely to remain a key driver for trading in today’s session given the lack of economic data or events. We’re seeing US futures paring some of yesterday’s gains which came on the back of Brainard’s dovish comments, while Gold has been given a marginal boost.

Oil remains under pressure again today after IEA reported that oil demand growth will be lower than expected this year, leaving OECD inventories at record highs of 3.111 billion barrels. This at a time when OPEC is pumping at near-record levels and non-OPEC countries are expected to pump at a faster rate than previously expected in 2017, with output growth now seen at 0.38 million barrels per day up from 0.3 million. News last week may have helped lift oil prices back towards the August highs but this data once again adds to the bearish case for oil, regardless of any “cooperation” between Saudi Arabia and Russia.

ASX lower as Asia treads water

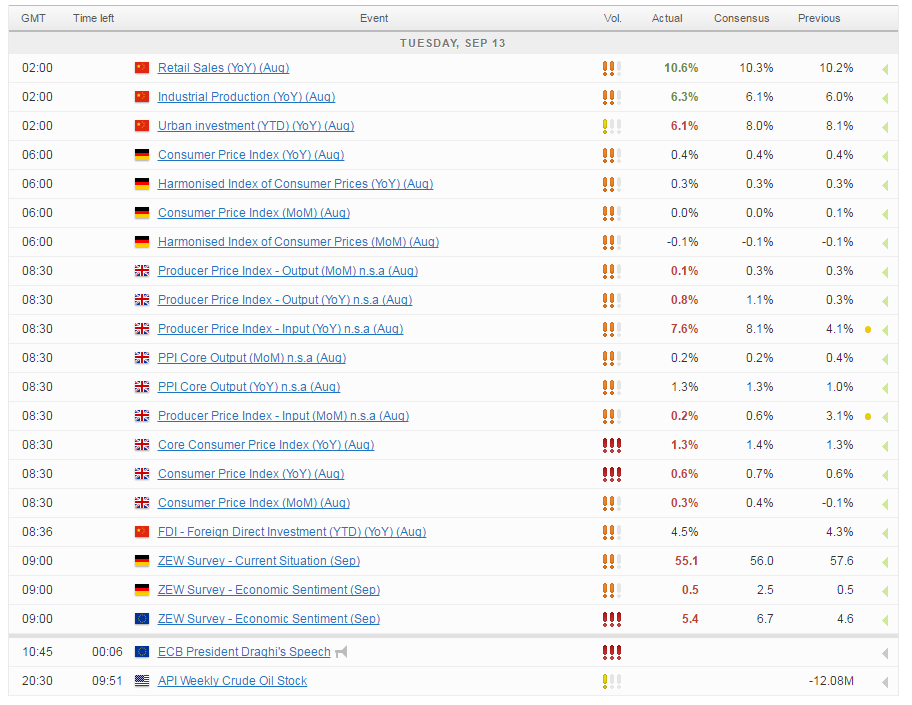

Inflation in the UK was unchanged in August, falling short of expectations of a small uptick, and yet PPI input prices once again surged – up 7.6% – as the depreciation of the pound ramped up costs for importers. While these higher costs may not yet be being passed through to the end consumer, it is highly likely that they will eventually lead to higher prices and cost cutting in other parts of the business which will likely mean less hiring and lower wage growth. At this point, consumer spending appetite will truly be tested. I don’t think today’s data will have any impact on the Bank of England’s position although I’m not convinced it will carry through with another rate cut this year given the resilient performance in the economy.

For a look at all of today’s economic events, check out our economic calendar.