This article by David Haggith was first published on The Great Recession Blog:

![Trump Tax Plan v Reagan Tax Plan (By George (16 - 1 (1)) [CC BY-SA 2.0 (http://creativecommons.org/licenses/by-sa/2.0)], via Wikimedia Commons)](http://thegreatrecession.info/blog/wp-content/uploads/Reagan-Trump-500x333.jpg)

If George Bush Senior thought Reaganomics was “voodoo economics,” he’d think the Trump tax plan was its kachina doll, and if GB Minor had been smoking weed while popping magic mushrooms when he made his eponymous tax cuts, the Bush Tax Cuts might have come out looking like the Wall-Street tax Fantasia that Trump’s peeps have brewed up — a plan that will make Donald Trump and the guests in his gold-plated penthouse much wealthier if enacted but will barely nudge the middle class.

Kudlow & Moore Triumph in Trump Tax Plan

What else would you expect when, as I pointed out in my last article, the Donald’s select team of economic advisors looks like a a Who’s Who of the Republican establishment? If you’re looking for an anti-establishment president, as I am, you might ask why Donald Trump is surrounding himself with establishment leaders and mouthpieces. Stephen Moore is a senior fellow of the Heritage Foundation and served as its chief economist. He’s been a constant champion of trickle-down economics (supply-side economics). Larry Kudlow is CNBC’s talking head (mainstream media guru), formerly paired as the conservative match with Mad Money’s Jim Cramer. He’s a career-spanning champion of the Republican establishment, particularly of trickle-down economics. Both are now shilling for the plan they created.

While their bonafide establishment credentials make them questionable anti-establishment advisors in the extreme (like a team of snakes being asked to design a better hen house), let’s not judge them by their associations but by their own words and actions:

In supporting the Trump tax plan, which is really Kudlow’s, Laughable Larry stated that Trump’s plan is a lot like Kennedy’s (by which I guess he means that Trump’s plan is a lot like one that a totally establishment Democrat would come up with):

He [Kennedy] proposed lowering marginal tax rates for all taxpayers and reducing the corporate tax. He advised lowering the top tax rate from 91 to 65 percent. In perhaps the most famous line from that path-breaking speech, he said: “In short, it is a paradoxical truth that tax rates are too high today and tax revenues too low, and the soundest way to raise revenues in the long run is to cut rates now.” (Newsmax)

Let’s see: Kennedy’s drop of the top rate to 65% was still double the top rate in Trump’s new plan. Obviously, Bowtie Larry goes by the view that, if a little medicine is a good thing, a whole lot is always better. According to Larry’s manic math, all tax cuts increase revenue. So, if you cut Kennedy’s top rate in half, you increase revenue even more. If that’s the case, why don’t we just cut the top tax rate to zero and enjoy the highest tax revenue the nation has ever seen? Larry, it appears, will spout any kind of economic drivel to support his establishment-coddling plan.

The tax plan Moore and Kudlow have hatched for Trump to run with should make the establishment overjoyed. When I hear Wall Street’s television talkers say how Trump will crash the economy, methinks the establishment doth protest too much just to convince all the disenfranchised that a vote for Trump is a vote for the common man. They know rebellion against the establishment is imminent. So, if Hillary doesn’t get elected, they need someone who will serve their interests who can capture the disenfranchised vote. Trump has now shown that he is that man.

This tax pan, which I’ll call the Trump Dreamliner, mounts a shiny gold body over that tired jalopy of a chassis known as “supply-side economics.” That old chassis rocketed the top ten percent of the population into rarified atmosphere and the top one percent into the stratosphere while the rest of the population bought into the plan on the floaty fantasy that someday that might be them up there, and they wouldn’t want the government taking their money if they ever managed to get some. As it turned out, though, the middle class was just a stage on the Dreamliner rocket, intended to get the top capsule into orbit, while the main stage took a splash-landing in the sea.

Lest you think I’m a closet Democrat for not buying the religion of Reaganomics, I’ll let you know that I voted for Reagan when he campaigned against the national debt. (That admission ought to be enough to get me hated by most liberals.) I also voted for George Bush the first time around. (More liberal hatred coming my way.) I also prefer to pay no more to the government than I absolutely have to, but I do NOT prefer to let the entire nation rot under a heap of debt or go derelict.

I learned by watching my own mistakes that Reaganomics failed to deliver on Reagan’s promise that it would cut the deficit and that it did not fail just because of Democrats in congress. In fact, at no time from Nixon on, has a cut in taxes caused our national deficit to shrink; but I’m not going to ask you to take my word on this. Let’s turn to the lead architect of Reaganomics to get his opinion of how well Reaganomics worked out.

David Stockman takes stock of Reaganomics and of the Trump Tax Plan

As Reagan’s chief budget advisor, David Stockman would have delighted in telling the world that Reagan’s tax cuts accomplished exactly what the Reagan administration promised … if he could as an honest man. Here is his own evaluation of the Reagan tax cuts in response to Trump’s tax plan: (I admire his honesty.)

What is profoundly disappointing about the Trump campaign’s stab at a semi-coherent economic plan is that it is a dog’s breakfast of some plausible policy ideas, really bad fiscal math and a relapse to the discredited, 35 year-old dogma of sweeping income tax cuts which pay for themselves.

They don’t. As the great Dwight D. Eisenhower proved in the context of the modern welfare and warfare states, politicians have to earn the right to favor the voters with tax reductions by firstdispensing the pain of spending cutbacks and without an exemption for the military-industrial complex, either.

Following those precepts, Ike balanced the budget several times; generated an average deficit of less than 1% of GDP during his tenure; shrank the defense budget by 33% in real terms; and presided over the strongest 8-year growth rate (about 3.3%) of any post-war GOP president, including Ronald Reagan.

By contrast, the Reagan White House—me included—-fell for the theory of “dynamic scoring” and that the big cuts in the income tax rates would partially pay for themselves via revenue “flowback”. Back in those days the latter was expressed in an economic forecast known as Rosy Scenario, which assumed that in response to the supply side tax cuts, the US economy would get up on its hind legs and leap forward at a real GDP growth rate of more than 4% per year, and as far as the eye could see.

What happened instead, of course, is that the US economy plunged into the drink of the deep 1982 recession and the Federal deficit soared to 5% of GDP—a truly shocking outcome back in those innocent days when the old-time fiscal religion still had roots inside the beltway. And it would have also caused enormous economic havoc had not the Gipper’s advisors—me included—talked him to signing three tax bills over 1982-1984 that recaptured roughly 40% of the revenue loss from his cherished tax cuts.

Even then, the public debt grew by 250% during Reagan’s eight years—-or by more than under any peacetime President in American history. Yet even to this day the GOP politicians and their economic advisers profess a case of heavy duty amnesia about what happened, claiming that real GDP grew by upwards of 4.5% and that these results were proof positive that “dynamic scoring” of budget of tax cuts is valid.

Worse still, they appear to have convinced Donald Trump of this same fallacious revisionist history because it was embedded at the core of the Thursday speech’s fiscal math. (David Stockman’s Contra Corner)

In short, Larry isn’t just laughable; he’s a lunatic because he cannot even see straight in hind sight. (Or more likely, just a greedy Wall Streeter, hoping to pull on over on the middle class … again.) On the other hand, you have to respect the one-and-only economist I’ve seen who can admit his mistakes and learn from them. As Stockman states, the other supply-siders ( such as Kudlow and Moore) still maintain the lie about Reaganomics without the balance that Stockman gives. Here’s Kudlow still repeating the lie:

Under the Gipper, tax rates were slashed from 70 percent to 28 percent, corporate taxes were cut, and numerous loopholes were closed. And the American economy grew mostly between 4 and 5 percent annually for over 25 years. (Newsmax)

Stockman, who helped engineer the plan, says growth was less than Ike’s 3.3% growth rate and that Reagan’s tax cuts proved way too deep at a top rate of 28%. They had to be raised substantially and very quickly to avert disaster. Even after the rates were notched back up to avoid “enormous economic havoc” (according to the architect of those rates), the country still grew only at the cost of historically large (at that time) accumulations of debt to make up the lost revenue.

Of course, the diehard dogmatists of Reaganomics will say that the huge expansion of debt that resulted from the lost revenue under Reagan and that made his military stimulus program work was entirely the fault of Democrats. However, Reagan never proposed a balanced federal budget in his lifetime — not even close. And you always have to play ball with the other side, which isn’t going to simply throw the game. If you don’t plan accordingly, you’re not living in reality. No party operates in a vacuum where they can spend as much as they want on everything they want and give nothing to the other party. So, the promise of Reaganomics was never realistic in the first place.

That’s why Stockman says you have to earn your way to tax cuts by making the large spending cuts first. It’s easy to convince people to reduce their taxes, but try taking away their favorite programs in order to make that work. The two-party system gives you two choices: welfare state or warfare state; but either state of being is funded mostly on mountains of debt. It is only a question of what each party is willing to go in debt for, and until both parties are willing to make deep cuts in programs they consider vital, mountains of debt will continue to pile in front of us.

As with all politicians, Trump proposes massive spending increases in many areas, making the spending cuts that would be required in other areas to balance the budget even more extreme; but he’ll never operate in a vacuum where he gets everything he wants to add and all the other guys lose all the things they want.

All of this is why Stockman says the Trump tax plan rests on bad fiscal math. (I’d say lunatic fiscal math now that we have the hindsight to know better — or should have.)

Many will argue that Reagan’s budget stimulated the economy, and I agree that it did. It is amazing what a heck of a bubblicious party you can have if you buy everything on the national credit card. It’s stunning to find out how much fun you have with your grandchildren’s money. Of course, the economy soared under Reagan for the simple reason that we weren’t paying for half of what we were buying and our debt was still small enough that the interest wasn’t yet strangling us. So, we had a ball.

Manufacturing all of that new military hardware put a lot of people to work at good-paying jobs, but Reagan didn’t pay for it as he went, and he never proposed such a politically abhorrent idea in any of his budgets. That was nothing short of Keynesian stimulus — only the deficit spending happened on building airplanes for the government and tanks and ships and guns and ammo — a wartime economy during a time of relative peace — rather than on the kinds of things Democrats would spend it on.

So, yes, tax cuts stimulate the economy. I would never argue that they don’t, but they do not stimulate it enough to pay for themselves, as Stockman is willing to honestly admit, but Trump’s advisors are not. Since Trump cannot make the deep cuts that his spending increases and tax cuts require, he simply promises that the economy will be so stimulated that it will automatically make up the difference. (Been there; done that; didn’t work.) Do you simply want to hear what you want to hear or want the truth? That’s what this comes down to.

Moreover, I’d argue that tax cuts targeted to the poor and middle class (demand-sideeconomics) do far more to stimulate the economy than tax cuts for the rich (supply-side) because the lower groups tend to spend their tax cuts on basic goods and services, not on vacations to Monte Carlo (that do nothing for America’s economy) or basketball teams … or stock purchases. Money also bubbles up much easier than it trickles down. The saved tax money that the middle class spends on needful things will always rise to the rich as if it had a homing device built in because the rich will more than gladly expand their manufactories to fill the demand. It seems to be almost an economic law that all money bubbles up. It’s peculiar to believe it trickles down, unless you really emphasize “trickle.”

Donald Trump’s tax plan trumps Ronald Reagan’s

As with every president from the Ronald to the Donald (if Trump wins), Trump plans to stimulate the economy with massive deficit spending, giving the largest tax breaks to the top ten percent while pretending to give breaks to everyone else. Just a quick look under the hood should tell you that, while the Trump tax plan is the most beautiful edition of the Dreamliner ever put out, there is a lot of old hardware under that shiny skin.

We have apparently become so completely addicted to debt that even Trump can find no other way to go forward but a whole lot more of the same debt-based economic expansion that took wing under Reagan. Trump’s tax plan uses the same smoke and mirrors the Republicrats have employed for thirty-plus years.

It starts by promising a modest cut in the income-tax rate of the rich from 39.6% to 33% while establishing rates of 25% and 12% for the lower and middle-income groups (with a large exemption that will leave the poor completely tax free). However, the aggregate changes of the lower tax rates are expected to improve after-tax income of the lower 80% of Americans by less than one percent. Not a lot of change for the middle class on taxable wages, but the rich get off better as always, even on the most modest part of the plan.

The Tax Foundation says,

The plan would lead to at least 0.8 percent higher after-tax income for all taxpayer quintiles. The plan would lead to at least 10.2 percent higher incomes for the top 1 percent of taxpayers or as much as 16.0 percent higher, depending on the nature of a key business policy provision. (“Details and Analysis of the Donald Trump Tax Reform Plan, September 2016“)

Typical. Let a token crumb fall to the middle class, while skimming twenty times as much (percentage wise) away from what the rich have to pay (who are already paying a smaller percentage of their income in taxes than the middle class) … on the promise, of course, that the benefits will eventually trickle down to help everyone who dines under the tables of the rich.

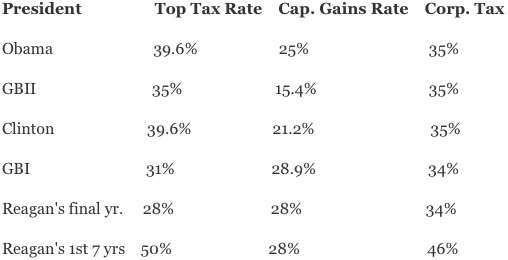

These tax rates, incidentally, match the tax rates of the existing plan proposed by House Republicans under Paul Ryan. So, the Trump’s tax plan puts him in rock-solid with the Republican establishment. The top rate is even lower than GBII’s top rate, lower than Clinton’s top rate, and much lower than the top rate in all Reagan years, except Reagan’s last.

As with the Trump tax plan, George Bush the Lesser also managed to get tax cuts that went deeper than Reagan’s, and we all witnessed how overnight the Bush Tax Cuts turned the US from its first surplus budgets in decades back to massive deficits. Rather than creating a solid growing economy in the US as the Bush Tax Cuts were supposed to do, the economy ended in the greatest fiscal train wreck in the lifetime of almost everyone alive today. I don’t see how anyone can look at the final mess and still say that, by going deeper than Reagan with his cuts, Bush helped move the economy into better times. It’s absurd.

Whether you like the truth or not, the national debt under Reagan and his protegé, George Bush the First, quadrupled over the accumulation from all previous presidents. Bad as that was, the national debt under GBII managed to more than double all of that! Yet, when you factor in all of Trump’s other tax cuts, you find that Donald Trump, thanks to his establishment advisors, is angling for cuts that even make the Bush Tax Cuts look like a corpse at the ball.

This time it will be different we are told by the Trump campaign and by Trump’s advisors, but we aren’t told why. Are we ever going to be capable of learning from the past?

Compare the rest of what Donald Trump and his alchemists have brewed for the future compared to this historic chart of tax rates under previous recent presidents:

Capital gains, capital pains

The Trump tax plan includes a reduction of capital gains tax to the historic low of 15% from its current 25! That’s lower than anytime since the Great Depression! That MASSIVE tax cut goes almost entirely to the rich. Capital gains tax cuts are the standard of the establishment.

Cap. gains tax cuts help those who make the easiest income (many of whom just sit around and place bets and who are now too lazy to even do that, so they have their robotraders do it for them while they wash down caviar with champagne and check their phones once in awhile to see how much money they are amassing). About two-thirds of this kind of lazy income goes to the top one percent. Whoohoo! They win again! But, if you thought Reagan’s capital gains tax cut was a major coup, the Donald’s cuts that rate almost in half again! This is Reaganomics on steroids.

Let’s get something clear that should be obvious to everyone but which seems to evade both Republicans and Democrats from top to bottom: the rich do not make their vast wealth off of wages like most of the rest of us. Therefore, a tax rate on ordinary wage income that is higher than the middle class at 33% is effectively as meaningless as advertising fat-free Kool Aid. (It never had it, never will; so, who cares?! But it sounds good.)

The rich make most of their wealth on capital gains. Donald Trump — to use the example of just one beneficiary of this immense tax transformation — makes most of his money off of gains in real estate investments. In many other cases, capital gains come from stock investments. So, Trump’s tax plan is the biggest gift to himself and his colleagues he has ever given — the biggest single drop in US taxes anyone has ever given in the history of the United States … and all the big cuts happen right where Trump will benefit most! Isn’t that convenient?

No wonder Trump is willing to personally fund part of his own campaign. If he wins the election and gets the Trump tax plan through, getting the presidency could yield a 100:1 return on Trump’s personal investment in the campaign. (That’s without figuring in the caché that being president adds to the Trump brand, since his name is the brand, and the brand is all about being big and important.)

This guy knows how to roll the dice for big stakes! (And that’s just from what he’ll save on capital gains taxes. We haven’t even gotten into the largest roll-back ever of corporate taxes, which will benefit all of Trump’s businesses. I’m saving that for the next article.)

Don’t expect to hear much about this in the mainstream conservative media (like Fox) nor from all those Wall Streeters feigning their disdain for Trump. They don’t want you to see what is behind all the smoke, and the Wall Streeters all know you hate them so much that if they liked Trump, you’d never vote for him; but, if they hate him, you’ll be convinced he must be good.)

This is why cuts in capital gains taxes are called “supply-side” economics. They give all the cuts to the people who fill all the orders and sell all the goods, not to the people who buy all the goods (the demand side). The dogma touted by establishment Republicans has always been that tax cuts for stock investors will stimulate the economy by giving the “job creators” more money to build factories.

If you haven’t noticed how few factories those capital-gains tax cuts built in America over the last three decades, there is not much point in my trying to help you notice now. You’re too blind to see past the skin of your eyeballs. Supply-side economics turned out to be a bridge to nowhere, and it is exactly what created the 1%/99% divide. All the money that the rich saved on taxes got spent on speculating the stock and housing markets upward, higher-priced football teams, and new factories in Mexico, India and China where labor was cheaper. It only helped America if you are among the top ten percent of Americans who are significant stockholders or real-estate investors. If you actually work for a living, you got nothing from any of it.

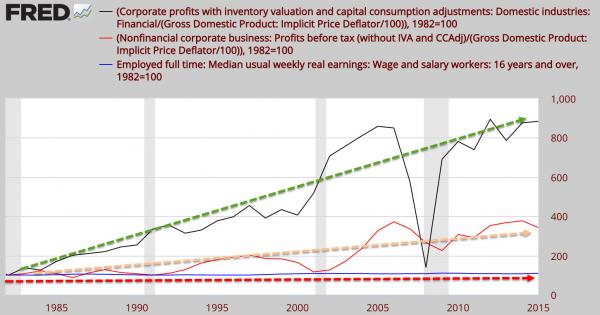

Nothing has trickled down since Reaganomics first went into play. Since 1982, the median wage for a middle-class worker has remained completely flat, once adjusted for inflation while profits enjoyed by Wall Street and other corporate stockholders have grown considerably:

Wall Street income has gone up 800%. Other corporate income has gone up 250%. Average middle-class worker: 9%. (I call that “completely flat” because a graphed slope of a 9% difference over the course of thirty years is so shallow water wouldn’t even run down it.) So, if you still believe in trickle-down economics and think its going to help you someday. Forget it … unless you are one of the top ten-percenters. It hasn’t, and it never will. And Trump’s plan, unfortunately, is the atom bomb of trickle-down economics.

If you fall for Lucy pulling the football out on you this time, Charley Brown, shame on you!

As I’ve pointed out before, you may hear things from Kudlow and Co. like “the top ten percent pay seventy-five percent of all the taxes,” as if that indicates the rich are paying far more than their fair share. What is left out of that equation every time is the nearly inconceivable truth that the top ten percent make more than 80% of all the wealth. Therefore, they are clearly paying less than their fair share. The latter fact is simply so hard to believe that people readily accept that the rich are paying a higher percentage of all their income in taxes than the rest.

If you don’t believe David Stockman when he tells you that the Donald’s tax plan will not bring in more revenue than the tax cuts it makes, consider that the US has never taken in as much revenue as it does right now — not by a long shot. Plans with lower taxes never brought in this much revenue, even when the economy was much stronger. So, the idea that further cuts will increase revenue enough to pay for themselves is as much a fantasy as Stockman says it is.

Will Trump’s plan stimulate the economy? Without a doubt? Will it put the nation deeper in debt? Without a doubt. As I said, you can throw one heck of a party when you make your grandchildren pay for it.

Reagan promised lower taxes would stimulate the economy to the point that his cuts would end deficit spending, but they only gave us years of the greatest deficits we’d ever known as he ramped up military spending. Bush promised his tax cuts would stimulate the economy only to wind up with the deadest economy most of us have ever experienced, which now requires vastly greater deficits just to keep this dying horse on life support (at least, that is the bill of goods we were sold).

If you want a true anti-establishment candidate, you had better get seriously angry about the Trump tax plan now and speak that anger out while Trump could be pressed to change his plan (not likely). If Trump wins the presidency, he will certainly take the victory as a mandate for his tax plan, and congress will take it that way, too, because the Trump tax plan serves their Wall-Street friends a bigger feast than they’ve ever known … and you’ll see the ultimate move of money to the top one percent.

My next article will cover Trump’s colossal corporate tax cuts, which I actually think could be a good idea if they were done right, but it does not appear they will be. Meanwhile, for further reading on Reaganomics and a picture in graphs that shows whether US citizens have done better economically under Republican administrations or Democrat admins, you might be interested in the most popular article I’ve written on this blog (which I posted a few years ago):

“Deficits, Debts and Democrats vs Republicans — US national debt in graphs by year and president”

Previous article in this series: “Trump: Trojan Horse for the Establishment or Mighty Mouth for Mankind?“

The post Trump Tax Plan Turns the Donald into Trickle-Down King appeared first on crude-oil.top.