“Low oil price is a function of excessive supply+true demand realization” – Reggie Middleton

There should be no surprise that Saudi refused to negotiate on a oil production freeze. They, like all of the other nations who depend on oil production, are in one hell of a pickle. The drop in price is now below everybody’s net operational breakeven point. Those nations that don’t have diversified revenues streams (read almost all of the OPEC nations) are being forced to dip into their piggy banks at an alarmingly rapid clip. A production freeze in a low economic growth/low demand environment means ceding market share – potentially permanently. Even if that isn’t the case, there are other factors at play which we will get to shortly.

This quotes from the afore-linked article says it all:

“Iran, which is reviving oil exports after international sanctions were lifted in January, ruled out any limits on its output before reaching pre-sanctions levels, dismissing the notion of joining the freeze as “ridiculous.””

Saudi Arabia’s Mohammed bin Salman, the 30-year-old deputy crown prince and favoured son of King Salman was not even in Doha, but issued the command from afar that a deal on production freezes was not to go through without the inclusion of Iran. It is obvious that Saudi Arabia’s oil policy is unequivocably in the hands of Deputy Crown Prince Mohammed bin Salman – and not in the hands of the Saudi delegation sent to Doha to negotiate.

Prince Mohammed gained significant clout after his father’s accession to the throne last year. He claimed the head of the defense ministry as well as the head of the economic council. With these, he controlled the war in Yemen and is masterminding Saudi’s plans for its post-oil era economy transition.

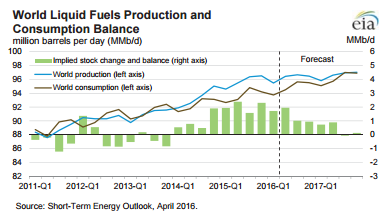

Saudi says they will raise production if necessary. Kuwait, who had a strike after the Doha meeting that spiked oil prices appears to be back online. Long story short, you have slackened demand and no shortage of supply waiting to slit their competitors throats to get to market, and a fundamental need for said suppliers to pump and sell due to budgetary considerations that extend significantly beyond oil pricing per barrel and production break even costs.

Bloomberg reports “How 315 Billion Petrodollars Evaporated“:

The 18 nations set to gather in Doha on Sunday to discuss a production freeze have spent $315 billion of their foreign-exchange reserves — about a fifth of their total — since the oil slump started in November 2014, according to data compiled by Bloomberg. In the last three months of 2015, reserves fell nearly $54 billion, the largest quarterly drop since the crisis started

The gathering in Doha will comprise both OPEC and non-OPEC states, though any deal to boost prices will probably be largely cosmetic as countries are already pumping nearly at record levels.

If you are already pumping at you flat out maximum capacity, it is very easy to promise not to raise production in a faux attempt to curb prices. You simply can’t produce more. Even if the oil producing nations can produce an accord on curbing productions, like the European banks – they simply can’t trust each other. The last voluntary production cap saw Russia break ranks and start producing more shortly thereafter. Now that everybody is hurting, there is more incentive than ever to through your oil producing neighbor under the bus.

Further, if that is not the case (but it is), production cuts may cause prices to increase as demand which is lower than supply) slowly eats away at the surplus – but then what happens?

The US shale producers that have been temporarily shuttered and waiting on the sidelines jump back in as soon prices cover cost of production ~ $30 to $65 per barrell. Then we’re back where we started from.

…Saudi Arabia accounts for nearly half of the decline in foreign-exchange reserves among oil producers, with $138 billion — or 23 percent of its total — followed by Russia, Algeria, Libya and Nigeria. In the final three months of last year, Saudi Arabia burned through $38.1 billion, the biggest quarterly reduction in data going back to 1962.

The oil slump started in November 2014 when the Organization of Petroleum Exporting Countries, led by the Saudis, decided to fight for market share — and bury U.S. producers — rather than cut production to support prices as it had done in the past. The policy sent Brent crude, the global oil benchmark, down from an annual average of $111 a barrel in 2013 to an average of just $35 so far this year. The plunge forced producers to tap their rainy day funds.

Fitch Ratings on Tuesday lowered the credit rating of Saudi Arabia to AA-, following similar steps already taken by Standard & Poor’s as well as Moody’s Investors Service. Fitch said that Riyadh would face large fiscal deficits this year and a “large share of the government’s financing needs will be funded by disposing of foreign financial assets.”

QE will continue, whether stealthily or outright. Why, you ask? Bloomberg states it plainly.

…Oil nations have traditionally held their reserves in U.S. Treasuries and other liquid securities. Nonetheless, the impact in credit markets has been muted as central banks continue to buy debt.

…In a letter inviting countries to the Doha meeting, Qatar Energy Minister Mohammed Al Sada said oil countries need to stabilize the market in “the interest of a healthier world economy as the present low price is seen to be benefiting no one.”

Actually it benefits everyone except oil producing nations that rely on said output, because low oil prices are really normal oil prices. You see, low oil price is a function of excessive supply+true demand realization.

There are three major producers today: Russia, Saudi Arabia and the U.S.

Russia produces at a breakeven of about $30 per barrel, and Saudi Arabia is under $10 per barrel but we (at Veritaseum – not being energy specialists) are not confident that we know the precise – or even approximate – amount it turns a profit at.

The U.S. is materially more diverse. It as its legacy oil fields, and the emergence of shale oil, which rapidly modified the profit levels. Two years ago shale sported a $70 per barrel breakeven, but with the advent of new technologies aimed at keeping them in the game as oil prices dropped, companies such as EOG Resources (EOG) state they can turn a profit at $40 per barrel or less. This diversity (in oil extraction business models) makes estimating US breakeven levels difficult, but it is safe to say that the US can throw supply at a wide variety of price levels and profit levels.

Of course, operational breakeven only tells a part of the story – and not the most interesting part either. Operational breakeven tells us how much the oil needs to be sold to break even to cover the production costs. Producers with monarchy-style or socialist governments (ex. like SaudiAramco), use oil revenues to carry fund the entire country’s social programs, plus other things – basically the whole economy. This is where economic diversity is key, and many of the OPEC nations aren’t economically diverse. For Saudi, the economic break even price is believed to be about $75 – $80 per barrel. Anything less than that causes the government to have to dip into its foreign reserves to fund the country and make up for any oil revenue shortfall.

- The potential for social unrest in Saudi Arabia as government handouts and subsidies disappear, annoying the populace and emboldening them to rise up against the monarchical government.

- Materially more military aggression in Russia as times get harder, Russia gets more demanding in putting its interests in line.

- The US comes out ahead here as it outputs enough oil to be put at the table yet is so diversified as to not depend on oil production whatsoever. Keep in mind that this all started when Saudi attempted to eliminate the output of US shale producers by pushing oil prices below their breakeven costs. This apparently backfired, multiple times. For one, they weren’t reading my writings or they would have foreseen the coming slump in demand. Second, US technology advantages have allowed some shale players to rapidly drop their cost of production. Third, if and when they attempt to raise prices by curtailing production, the less efficient shale producers will come back online adding supply and pushing prices back down again. At the rate that the Saudis are burning through their petrodollar reserves, they will be out of money by next year if oil prices don’t break ~$70 – $80 per barrel. That may be a problem with all of the shale on the sideline and a guaranteed worldwide economic slump already here – further subdued by a global banking system saddled with NPLs.

So, why is Saudi Arabia hell bent on what appears to be a suicide mission? Because there’s more at play here than most westerners discern without a much closer look (and there always is). The Saudi family is apparently weaponizing its vast oil production capabilities and using it for political influence against their rivals, the Shia and particularly Iran.

Once it comes to the Middle East, this is where Geo-politics and Socio-economics collide…

According to Wikipedia:

The Strait of Hormuz/h??r?mu?z/Persian: ???? ???? Tangeh-ye Hormoz![]() listen (help·info), Arabic:????? ?????? Ma??q Hurmuz) is a strait between the Gulf of Oman and the Persian Gulf. It is the only sea passage from the Persian Gulf to the open ocean and is one of the world’s most strategically important choke points. On the north coast is Iran, and on the south coast is the United Arab Emiratesand Musandam, an exclave of Oman. At its narrowest, the strait is 29 nautical miles (54 km) wide. According to the U.S. Energy Information Administration, in the year 2011, an average of 14 tankers per day passed out of the Persian Gulf through the Strait carrying 17 million barrels (2,700,000 m3) of crude oil. This was said to represent 35% of the world’s seaborne oil shipments and 20% of oil traded worldwide. The report stated that more than 85% of these crude oil exports went to Asian markets, with Japan, India, South Korea and China the largest destinations. A 2007 report from the Center for Strategic and International Studies also stated that 17 million barrels passed out of the Persian Gulf daily, but that oil flows through the Strait accounted for roughly 40% of all world-traded oil.

listen (help·info), Arabic:????? ?????? Ma??q Hurmuz) is a strait between the Gulf of Oman and the Persian Gulf. It is the only sea passage from the Persian Gulf to the open ocean and is one of the world’s most strategically important choke points. On the north coast is Iran, and on the south coast is the United Arab Emiratesand Musandam, an exclave of Oman. At its narrowest, the strait is 29 nautical miles (54 km) wide. According to the U.S. Energy Information Administration, in the year 2011, an average of 14 tankers per day passed out of the Persian Gulf through the Strait carrying 17 million barrels (2,700,000 m3) of crude oil. This was said to represent 35% of the world’s seaborne oil shipments and 20% of oil traded worldwide. The report stated that more than 85% of these crude oil exports went to Asian markets, with Japan, India, South Korea and China the largest destinations. A 2007 report from the Center for Strategic and International Studies also stated that 17 million barrels passed out of the Persian Gulf daily, but that oil flows through the Strait accounted for roughly 40% of all world-traded oil.

Almost all (85%) of Muslims are Sunnis, and are the majority in the nation to the southwest of the strait, Saudi Arabia, as well as Yemen and Algeria. Shiites are the majority in Iran and Iraq, and have large minority communities in Yemen, Bahrain and Syria (Source: About.com Islam, About.com Middle East). The Sunnis (including Saudi) are waging economic war on the Shiites) including Iran. Or, it can be said that the Shiites have waged economic war on the Sunnis (by pumping full out and refusing to even attend the Doha conference, which was considered to be a sham by many pundits anyway).

As you know, the US has attacked Iran multiple times – and the map makes reasons obvious. They are quite the strategic petrodollar location. The US has tightly allied itself with Saudi. Again, the reasons are obvious looking at the maps and the size of Saudi’s petrodollar output. Even now, the US has assets to keep an eye on Iran after it has lifted sanctions and allowed them to pump oil freely.Again, as per Wikipedia:

Millennium Challenge 2002 was a major war game exercise conducted by the United States armed forces in 2002. According to a 2012 article in The Christian Science Monitor, it simulated an attempt by Iran to close the strait. The assumptions and results were controversial.[31]

A 2008 article in International Security contended that Iran could seal off or impede traffic in the Strait for a month, and an attempt by the U.S. to reopen it would be likely to escalate the conflict.[32] In a later issue, however, the journal published a response which questioned some key assumptions and suggested a much shorter timeline for re-opening.[33]

In December 2011, Iran’s navy began a ten-day exercise in international waters along the strait. The Iranian Navy Commander, Rear Admiral Habibollah Sayyari, stated that the strait would not be closed during the exercise; Iranian forces could easily accomplish that but such a decision must be made at a political level.[34][35]

Captain John Kirby, a Pentagon spokesman, was quoted in a December 2011 Reuters article: “Efforts to increase tension in that part of the world are unhelpful and counter-productive. For our part, we are comfortable that we have in the region sufficient capabilities to honor our commitments to our friends and partners, as well as the international community.” In the same article, Suzanne Maloney, an Iran expert at the Brookings Institution, said, “The expectation is that the U.S. military could address any Iranian threat relatively quickly.”[36]

General Martin Dempsey, Chairman of the Joint Chiefs of Staff, said in January 2012 that Iran “has invested in capabilities that could, in fact, for a period of time block the Strait of Hormuz.” He also stated, “We’ve invested in capabilities to ensure that if that happens, we can defeat that.”

In June 2012, Saudi Arabia reopened the Iraq Pipeline through Saudi Arabia (IPSA), which was confiscated from Iraq in 2001 and travels from Iraq across Saudi Arabia to a Red Sea port. It will have a capacity of 1.65 million barrels per day.

In July 2012, the UAE began using a new pipeline from the Habshan fields in Abu Dhabi to the Fujairah oil terminal on the Gulf of Oman, effectively bypassing the Strait of Hormuz. It was constructed by China and will have a maximum capacity of around 2 million barrels per day, over three-fourths of the UAE’s 2012 production rate. The UAE is also increasing Fujairah’s storage and off-loading capacities.

In a July 2012 Foreign Policy article, Gal Luft compared Iran and the Strait of Hormuz to the Ottoman Empire and the Dardanelles, a choke point for shipments of Russian grain a century ago. He indicated that tensions involving the Strait of Hormuz are leading those currently dependent on shipments from the Persian Gulf to find alternative shipping capabilities. He stated that Saudi Arabia was considering building new pipelines toOman and Yemen, and that Iraq might revive the disused Iraq-Syria pipeline to ship crude to the Mediterranean. Luft stated that reducing Hormuz traffic “presents the West with a new opportunity to augment its current Iran containment strategy.”

If you look at the oil production breakeven chart above, Iran’s breakeven point is considerably above Saudi’s, even when budgetary considerations are taken into play. This is why the US sanctions where effective against Iran, and this is also the pressure point that Saudi appears to be aiming for – much more so than US shale manufacturers. The problem is, US shale manufacturers do exist and they will bring massive amounts of oil online before the breakeven point of Iran. Iran will pump full out regardless, for it is aiming to regain its pre-sanction status among the major oil producing nations, and it is not playing games.

I detailed how to monetize this through Veritasuem in The Bearish Case Against Oil Gets… Bearier…. We are tweaking the system to allow hedge funds to make more granular bullish and bearish bets deeper into this malaise.

As excerpted:

Oh yeah, in case you didn’t know, you can use smart contracts and blockchain to take a bullish or bearish position on oil or the publicly traded equity or debt of any oil company on a P2P basis, without counterparty risk, credit risk, a brokerage account or even a conventional exchange.

Reference this smart contract setup through Veritaseum:

Why pay for your short oil with a USD/EUR pair? Because the banks in the euro zone are going to need more ECB welfare, which will put even more pressure on the euro relative to the dollar. It’s free leverage… That is if we’re right. EU banks don’t only have exposure to each other (bad enough) and the deteriorating EU economy (worse) and the continuous buildup of NPLs (horrible, but nobody is admitting it) but they also have exposure to this oil mess. It’s not just US banks, you know – as excerpted from “The First Bank Likely to Fall in the Great European Banking Crisis” proprietary research report…

This trade setup was suggested last Wednesday, April 13th at roughly 12 pm. It is currently very close to being unwound (maximum P/L) at 100% gross profit. Reference the following charts…

Anyone interested in knowing more about the first company to issue public smart contracts traded on the public blockchain, or the company to file the first patent applications for the use of blockchain tech as applies to capital markets (yes, we were the first) or the only company that is creating on-ramps to the blockchain-powered peer-to-peer economy (think peer-to-peer capital markets vs. the legacy hub and spoke model) should contact me directly (reggie AT veritaseum.com. We have a lot to talk about.

More about the trading platform…

The post Witness the 95% Gross Profit on Recommended Oil Trade While Experts Await Higher Prices: I See A New Energy Paradigm appeared first on crude-oil.top.